Why Congressional Insider Trading Is Legal – and Potentially Profitable

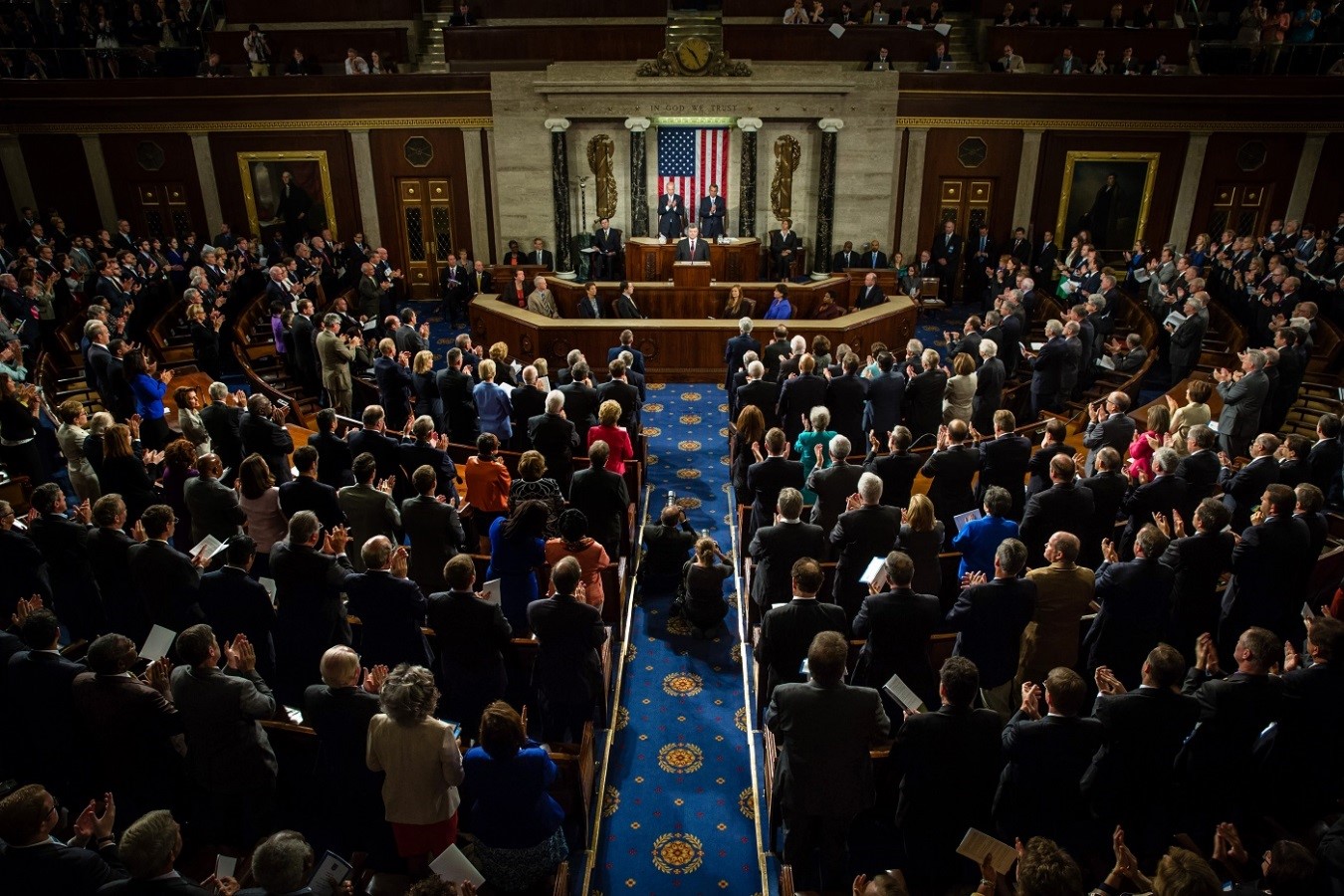

We Americans pride ourselves on building a system of government where no one is above the law – not even the lawmakers themselves. Except… well, sometimes they kind of are. As this chart shows, members of Congress have historically done a lot better in the stock market than the average American household. This suspicious outperformance is made possible by the widespread and technically legal practice of congressional insider trading.

As our Income Expert Marc Lichtenfeld wrote a few years ago…

I know a nearly foolproof way of getting rich. It doesn’t involve signing up for one of The Oxford Club’s services, and it doesn’t require much risk because you already know the outcome. In fact, you’ll help decide it. One thing you can do to increase your net worth by 10-fold is get elected to Congress.

It’s easy to understand how our representatives and senators obtain valuable financial information. Congress makes important decisions about economic policy, foreign relations, tax reform and other matters that directly affect the bottom lines of publicly traded companies.

And every few months there seems to be a member of Congress or their spouse in the headlines because of insider trading. Before a major act is passed, they often trade in sectors around the act in question. Which is understandably frustrating to the average American that doesn’t have access to this advanced insider information.

But there are more interesting questions to be asked about this seedy phenomenon. How does Congress get away with insider trading? And how can you take advantage of this lucrative legal gray area?

Why Is Congressional Insider Trading Legal?

By the letter of the law, it is. In 2012, President Obama signed the Stop Trading on Congressional Knowledge (STOCK) Act.

This law sought to crack down on white-collar crime in Washington. Among other provisions, it instituted strict disclosure requirements for congressmen who were buying and selling securities.

At first, the law worked like a charm. The number of stock transactions made by congressmen plunged more than 50% from 2011 to 2012. Those who kept trading had to post their trades to a searchable online database available to the general public.

Keep Reading This Article to Find Out Why Congressional Insider Trading Is No Longer Illegal

Enter your email below to read the rest of this article and reveal why congressional insider trading is legal again.

You’ll also be opted in to receive our free daily e-letter, Liberty Through Wealth, where you will find our expert investment insight, analysis and stock picks for all the best investment opportunities.

Nunc ut lorem quis urna auctor ornare quis in sem. Donec sodales viverra ante, et scelerisque libero iaculis sit amet. Phasellus fermentum vitae tellus quis suscipit. Ut bibendum aliquet odio, a venenatis augue fermentum at. Nunc fringilla dui lorem, congue blandit ex egestas in. Vestibulum dapibus orci ut felis consequat euismod. Sed pretium, risus vel blandit porttitor, diam diam sodales dui, in lobortis lorem ex vitae est. Nullam ac venenatis massa. Integer blandit, diam et fringilla semper, nulla dui suscipit urna, eget hendrerit quam ex rutrum tellus. Nam imperdiet, nibh nec mollis vulputate, felis ante posuere leo, at ultrices nulla neque vitae mi.Nunc ut lorem quis urna auctor ornare quis in sem. Donec sodales viverra ante, et scelerisque libero iaculis sit amet. Phasellus fermentum vitae tellus quis suscipit. Ut bibendum aliquet odio, a venenatis augue fermentum at. Nunc fringilla dui lorem, congue blandit ex egestas in. Vestibulum dapibus orci ut felis consequat euismod. Sed pretium, risus vel blandit porttitor, diam diam sodales dui, in lobortis lorem ex vitae est. Nullam ac venenatis massa. Integer blandit, diam et fringilla semper, nulla dui suscipit urna, eget hendrerit quam ex rutrum tellus. Nam imperdiet, nibh nec mollis vulputate, felis ante posuere leo, at ultrices nulla neque vitae mi.

Integer blandit, diam et fringilla semper, nulla dui suscipit urna, eget hendrerit quam ex rutrum tellus. Nam imperdiet, nibh nec mollis vulputate, felis ante posuere leo, at ultrices nulla neque vitae mi.Nunc ut lorem quis urna auctor ornare quis in sem. Donec sodales viverra ante, et scelerisque libero iaculis sit amet. Phasellus fermentum vitae tellus quis suscipit. Ut bibendum aliquet odio, a venenatis augue fermentum at. Nunc fringilla dui lorem, congue blandit ex egestas in. Vestibulum dapibus orci ut felis consequat euismod. Sed pretium, risus vel blandit porttitor, diam diam sodales dui, in lobortis lorem ex vitae est. Nullam ac venenatis massa. Integer blandit, diam et fringilla semper, nulla dui suscipit urna, eget hendrerit quam ex rutrum tellus. Nam imperdiet, nibh nec mollis vulputate, felis ante posuere leo, at ultrices nulla neque vitae mi.

A Possible End to Congressional Insider Trading

The impact of Congressional insider trading became more apparent in the lead up to the pandemic. Members of Congress were briefed behind closed doors about the true dangers of COVID-19 before most people even had it on their radars. This allowed them to sell their securities ahead of the massive stock market crash.

But there is a proposed solution. Some senators are proposing legislation to ban members of Congress from trading individual stocks. This would required congresspeople and their immediate family members to either place their stocks in a blind trust or sell them altogether.

There is the expected divide over this issue so it’s unclear whether it will ever get passed. But, it could be a step towards ending the loophole in Congressional insider trading.

*The views and opinions expressed in this article are those of the author and do not necessarily reflect the official position of Wall Street analysts.