What Is Futures Trading and How to Get Started

Futures trading is one of the oldest forms of investing out there. It dates back to the dawn of civilization in ancient Mesopotamia. The ancient Greeks were a big fan too. Aristotle wrote about the practice in his classic treatise Politics. Despite the fact that the practice has been around so long, the question for many remains, “What is futures trading?”

To answer the question, let’s start with a quick history lesson.

The sixth Babylonian king, Hammurabi, is credited with the creation of one of the first legal codes: The Code of Hammurabi. In it, the king laid the foundation for the sale of goods and assets for an agreed-upon price at a future date.

As long as there was a written contract and an eye witness, this allowed a merchant to set the price he was willing to pay for goods later on. For instance, let’s say a merchant had a hunch that the year’s apricot harvest was going to be low. Due to the laws of supply and demand, that would make apricots more valuable come harvest season.

If the savvy merchant locked in last year’s price long before the apricots were harvested and supply was short, he wouldn’t have to pay the inflated price. And even better, he would be able to sell them at the higher rate.

Now, to be fair, this wasn’t just a means to rook the farmer out of a few shekels per bushel. This also benefitted the farmer, because he knew that he was guaranteed to sell a portion of his harvest. And the opposite could just have easily happened. If there were a glut of apricots that year, the merchant would have still been obligated to pay the agreed-upon price, despite the increase in supply and likely lower prices.

Futures vs. Options

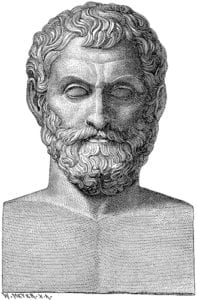

There are diverging tales regarding the Greek mathematician Thales of Miletus and his impact on futures trading. It appears to come down to the interpretation of Aristotle’s work. But either way, he’s either responsible for futures trading’s resurgence… or for the creation of options.

In one translation, Thales predicted a massive olive harvest. So he went about and bought every single olive press in the city. He bet that demand would be high, and his bet on the future need for the presses paid off when he was able to sell them at a premium.

In another interpretation, Thales reserved the olive presses in advance at a discount. And when the olive harvest turned out to be a strong one, he rented the presses out at a premium and turned a tidy profit.

The difference between the two is subtle, but profound. In the former, Thales took control of the actual goods used to press the olives… gambling on the future value of his possessions. In the latter, he held a contract on the value of the underlying goods, one that he could exercise if he so chose.

If the olive harvest was a bust, he still had options. He could give up control of the presses and sell his rental contracts to someone else at a loss. He could also simply walk away from the contracts. Or he could rent the presses out at a discount to minimize his losses.

In other words, he had the option to take control of the underlying goods or to sell his stake in control of them, a less risky bet than outright buying the presses, because less capital was at stake.

What Is Futures Trading Today?

Most modern-day futures traders don’t have any interest in physically owning apricots or olive presses… though the traditional method of futures trading is still done by commercial buyers, producers and merchants. But for our purposes, we’re going to assume readers don’t want to buy actual lean hog or 1,000 barrels of crude oil.

Instead, let’s look at how speculators who are not looking to buy and sell physical commodities can profit by simply betting on future prices. And there are all kinds of assets that futures traders can invest in.

The Chicago Mercantile Exchange – better known as the Chicago Merc – allows futures traders to speculate on agriculture, energy, interest rates, precious metals, real estate, stock indexes and even the weather.

Futures trading is just another way for investors to capitalize on macro- or microeconomic conditions. Let’s look at 2007 for an example. There was significant growth in car sales in China and Latin America. There was also conflict in major oil-producing countries, which led to uncertainty in the world supply of oil.

A savvy futures trader who saw this coming could have picked up futures contracts representing 1,000 barrels of crude oil at a strike price of less than $65 per barrel. By the following year (as long as the contract didn’t expire beforehand), that contract would have been worth a handsome sum. When oil prices spiked at more than $109 a contract, guaranteeing a $65 price point would have been extremely valuable to some.

But again, speculators aren’t going to want to have 1,000 barrels of oil delivered to their homes. But for a commercial buyer looking to turn that oil into fuel, that contract would have been extremely valuable. So in this regard, modern speculators playing the futures market are really trading in options. They add liquidity to the futures market. And commercial buyers and producers are the ones who actually exercise the rights on these futures contracts.

Futures Contracts Explained

You can pick up futures contracts on any standardized exchange… all from the comfort of your couch. Each contract contains important information, like…

- A unit of measurement of the goods (in the oil industry, a barrel of oil is 42 U.S. gallons)

- The quantity of goods (again, in the oil industry, futures contracts control 1,000 barrels)

- The currency said contract will be exercised in

- The strike price (or price of said goods)

- An expiration date.

Now, to get started, all you have to do is open an account with a brokerage that supports the market you want to invest in. This part is easy. But be sure to make it clear that you do not want to take ownership of the product. They’ll just ask you a few simple questions, like…

- How much trading experience do you have?

- What is your income?

- What is your estimated net worth?

These questions allow the broker to determine how much risk and margin to allow you to take on. But a word of caution… there is no standard commission structure for brokerages that operate in futures. So it’s vital you do your homework. It’s best to search around and get some quotes before jumping into futures contracts.

Do Your Futures Look Bright?

Now that you have a better idea of what futures trading is, you might feel like you’re ready to get started. But like with any new investment opportunity, it’s best to test your strategy before getting started. There are lots of futures trading simulators that allow new investors to paper trade. This is a great way to dip your toe into futures trading without risking your nest egg.

If all of this sounds a little complicated, that’s because it is. So if you decide futures trading isn’t for you, don’t worry. There are plenty of other ways to start building your wealth.

But either way, be sure to up for the Investment U e-letter below. This will help keep you up-to-date on new investment opportunities. And you’ll receive daily wealth creation tips and stay ahead of the markets to spot next big trend before it happens.

Read Next: What Is Swing Trading in the Stock Market

4 Comments

[…] In this day and age, it’s no longer simply the CME that provides derivatives buying and selling. Widespread exchanges like Kraken, eToro or even TD Ameritrade be offering techniques to industry futures contracts now. Actually, this could be an excellent more straightforward approach to learn to quick crypto for other folks which can be unfamiliar with one of the most widespread crypto exchanges. And when you’d like to be informed extra about futures buying and selling, simply apply this hyperlink. […]

[…] As of late, it’s not simply the CME that provides derivatives buying and selling. Standard exchanges like Kraken, eToro and even TD Ameritrade supply methods to commerce futures contracts now. In reality, this may be a good simpler option to discover ways to brief crypto for folk which are unfamiliar with among the standard crypto exchanges. And if you happen to’d prefer to study extra about futures buying and selling, simply follow this link. […]

[…] These days, it’s not just the CME that offers derivatives trading. Popular exchanges like Kraken, eToro and even TD Ameritrade offer ways to trade futures contracts now. In fact, this might be an even easier way to learn how to short crypto for folks that are unfamiliar with some of the popular crypto exchanges. And if you’d like to learn more about futures trading, just follow this link. […]

[…] These days, it’s not just the CME that offers derivatives trading. Popular exchanges like Kraken, eToro and even TD Ameritrade offer ways to trade futures contracts now. In fact, this might be an even easier way to learn how to short crypto for folks that are unfamiliar with some of the popular crypto exchanges. And if you’d like to learn more about futures trading, just follow this link. […]