What Is Compound Interest?

The most powerful force in the world of investing is compound interest. In fact, Albert Einstein once called compound interest the “eighth wonder of the world!” But what is compound interest? Why was it such a marvel to one of the brightest minds of the modern era? To understand, it’s best to break down the concept into both practical and mathematical explanations.

If you’re an investor, you need to know what compound interest is, how it works and how to earn it. So much of your wealth-building opportunities come from compound interest. Here’s a crash-course in compound interest and how to leverage it into your plans to generate wealth far into the future.

The Definition of Compound Interest

Compound interest is the continued addition of interest payments to the principal balance. This kickstarts a growth cycle where, each time interest compounds, it’s generated by a higher and higher balance. It’s a definition best illustrated with an example.

Consider the sum of money you’d have after 30 days if you start with a penny and double the principal every day. While you’d still only have a handful of change at the end of your first week, by day 15 your balance would be $163.84. By day 20, it’d be $5,242.88. And, by day 30, you’d have more than $5.3 million to show for your compounding. This example is one of the very best for illustrating the power of compound interest—even if it’s an extreme one.

The reality is that most interest compounds a few percent at a time, over a longer time period. For example, the stock you own might pay a 2.15% dividend every quarter. Or, your index fund may return 9% annually. The key factor to building wealth in this case is time. The more compounding periods, the more that’s added to the principal balance and the greater the next amount compounded.

How to Calculate Compound Interest

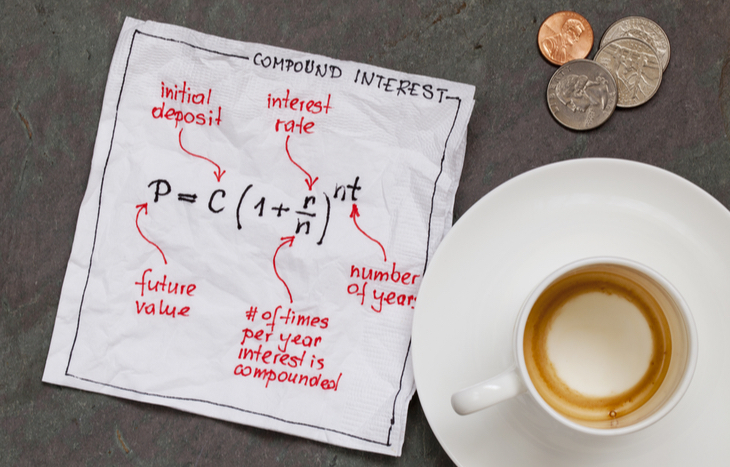

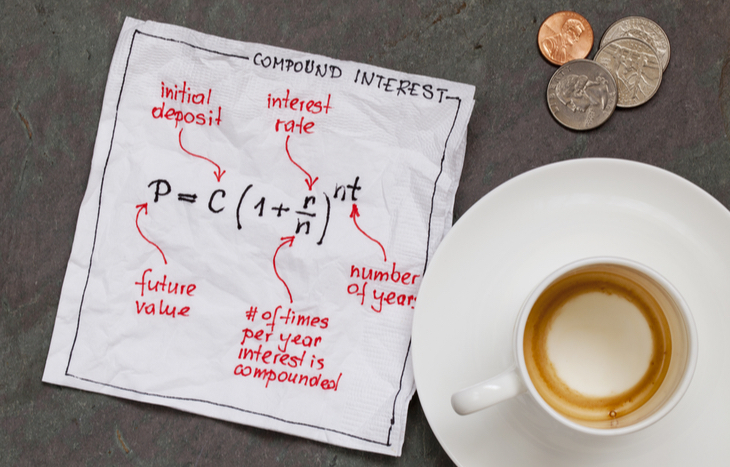

For those who prefer a mathematical look at the power of compound interest, there’s a specific formula to calculate it: P(1 +r/n)nt. In this formula:

- P = the initial principal balance

- r = the interest rate

- n = the number of times interest is applied

- t = the number of time periods elapsed

By investing standards, this formula is actually very simple. In most cases, the interest rate and number of times interest applies are fixed, which gives investors more control over the other variables. You can continue to increase your principal balance over time through reinvestment. And, the longer you allow your funds to compound, the larger that balance grows.

Examples of Compounding Growth Over Time

Many investments offer compounding opportunities. It’s a matter of recognizing the different options for compound interest and understanding how much and how often compounding takes place. Here are a few basic examples:

- Marcy invests in an S&P 500 index fund for 20 years, averaging a 7% return annually. Her initial balance of $5,000 and monthly contribution of $250 will have grown to over $150,000 when she checks it again.

- Dalton holds shares in XYZ Company, which pays a quarterly dividend of 2%. Over a five-year period, the stock itself grows 50%. At the same time, Dalton has reinvested dividends, which have bought fractional shares and allowed him to grow his holdings exponentially.

Any investment that adds accumulated gains to principal to empower even more wealth generation is an example of compounding. Whether it’s stocks, bonds, funds or a different investment vehicle, the objective is to grow the principal through ROI, to beget even more earning power.

Want a more comprehensive look at the power of compounding? Check out our investment calculator and plug in your own investment numbers to see how compound interest affects your accumulation over time.

How to Maximize Compounding

Whether you’re compounding through debt or equity securities, or through a different mode of investment, there are a few ways to maximize its potential. Here’s a look at some of the best strategies:

- Time spent invested. The more compounding periods there are, the more accumulation per period. Translation: the longer you keep building principal, the more money it’s going to make.

- Continued investments. Continuing to invest principal is a powerful way to speed up accumulation. Not only will compounding increase ROI, so will the continued contribution to the fund balance.

- Reinvestment. If your investment pays dividends or offers other reinvestment opportunities, take them! Like continued principal investment, these additional paybacks will boost earning power.

- Optimal interest rate. The higher the interest rate (or rate of return), the power money that’s added to the principal balance. Look for investments with a track record of high-percentage interest rates.

There are dozens of other ways to optimize compounding that are investment-specific. Look for ways to maximize the variables you have control over: time, contributions, mode of investment and more.

Compounding is The Key to Wealth Building

Albert Einstein also had another quote about compound interest: “he who understands it, earns it; he who doesn’t, pays it.” The concept is a simple one. In the realm of investments, compound interest works in your favor. If you’re trapped in debt, every passing month compounds more debt on top of you. This is why it’s so important to understand compounding in the context of wealth building. If you’re not on the right side of compound interest, you’ll need to work hard to get there.

And you can start by signing up for the Investment U e-letter below. This daily newsletter will help you gain a better understanding of financing and the power of investments.

What is compound interest? Outside of a wealth building tool, it’s your guiding force for security in the future. Taking the time to make smart investments that capitalize on compound interest will give you the peace of mind you need to let your money grow. Then, it’s just a waiting game as you watch your wealth accumulate.

8 Comments

[…] enter the variables, the CD calculator automatically updates. You’ll see how the investment and interest compound each […]

[…] from the fact that it doesn’t account for compounded interest, there are a couple of other glaring limitations of AAGR. The biggest is that it doesn’t account […]

[…] from the fact that it doesn’t account for compounded interest, there are a couple of other glaring limitations of AAGR. The biggest is that it doesn’t account […]

[…] example illustrates the massive impact of compounding returns of even a tiny dividend from growth stocks with […]

[…] example illustrates the massive impact of compounding returns of even a tiny dividend from growth stocks with […]

[…] most important good thing about making an investment is compounding returns. Compounding returns is the speed at which your funding returns gather over time. Once a year that […]

[…] from here? Is it better to pay off your mortgage or invest?The biggest advantage of investing is compounding returns. Compounding returns is the rate at which your investment returns accumulate over the years. Every […]

[…] biggest advantage of investing is compounding returns. Compounding returns is the rate at which your investment returns accumulate over the years. Every […]