Volatility Is Here to Stay

As I watched Novak Djokovic and Denis Kudla furiously whip the ball back and forth over the net this weekend at the U.S. Open, I felt a familiar sensation.

Oh right, it was the same one I had watching the stock market in August.

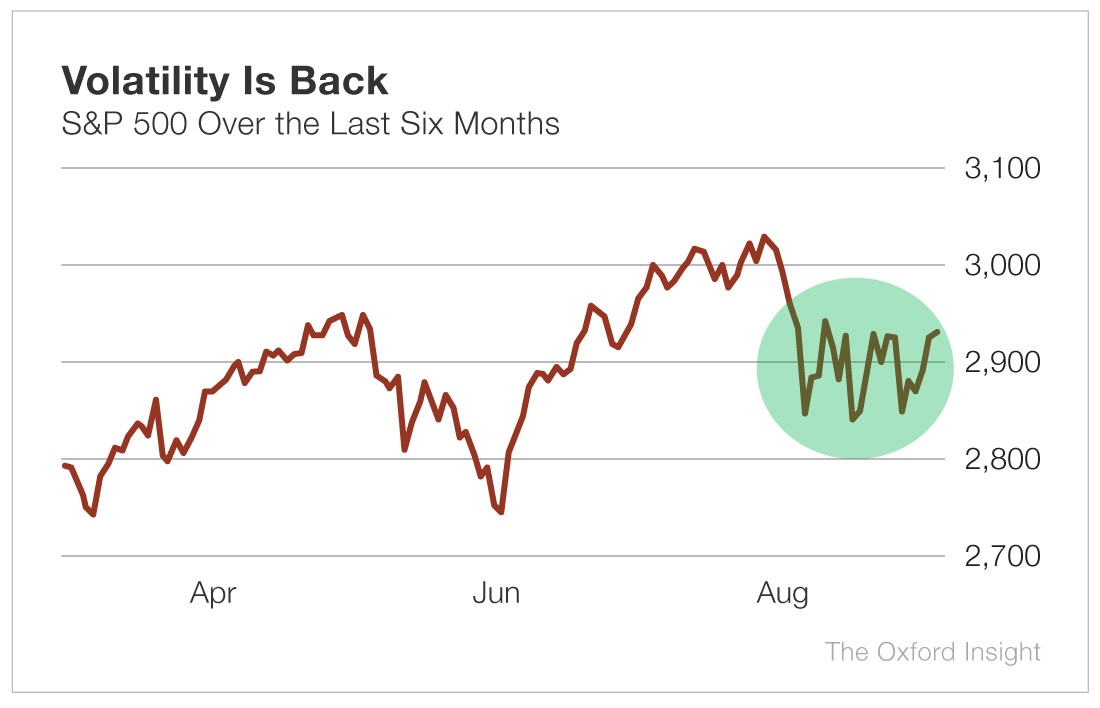

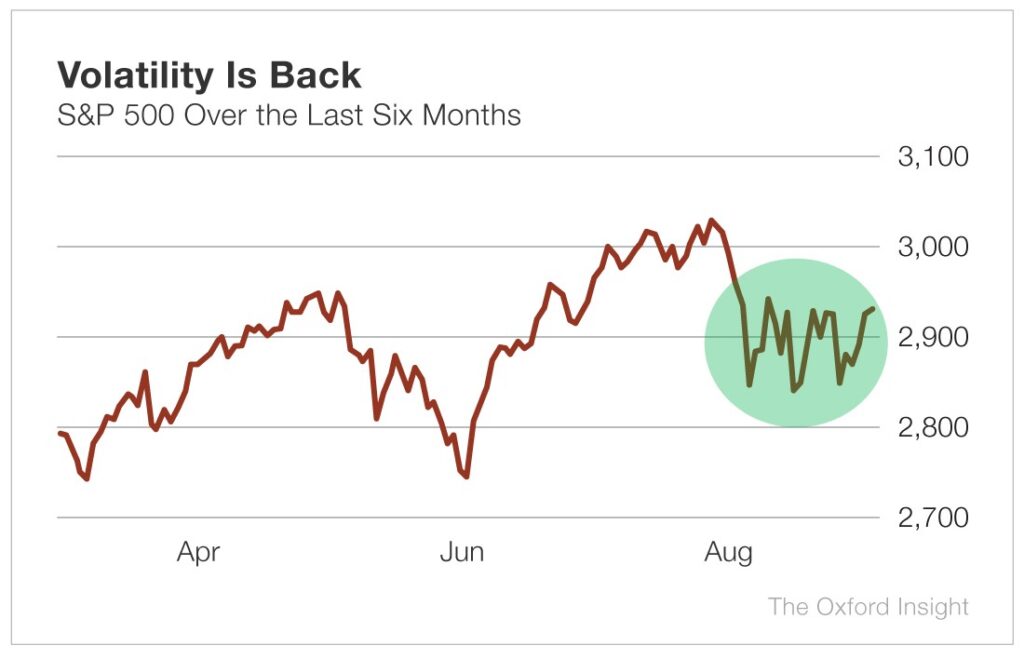

The market swung wildly last month, sending the Chicago Board Options Exchange’s Volatility Index soaring to 24.6, the highest level for the year.

The S&P 500 Index moved 1% or more on 11 trading days and posted three drops of 2.6% or more – including a 3% decline on August 5, the worst day for the index this year. Historically, the S&P sees only around four 1% days each month.

What’s driving this increased volatility?

Well, President Trump certainly has a lot to do with it.

His China trade brinkmanship roiled markets all month, and it seemed to get worse by the week. He announced higher tariffs on some $250 billion worth of imports from China, which come on top of other punitive tariffs that went into effect September 1.

Trump also called Chinese President Xi Jinping an “enemy” of the U.S. and directed American companies to “immediately start looking for an alternative to China.”

Over the past 2 1/2 years, I’ve grown accustomed to Trump’s braggadocio and wild claims, but that latest one – ordering American firms to exit China – took me by surprise, I have to admit.

It surprised markets too, sending the Dow down more than 600 points that day.

But it wasn’t just Trump in August. An inverted yield curve – with yields on long-term bonds falling below those on short-term debt – sent a shiver down investors’ spines.

An inverted curve won’t cause a recession (though a trade war can). It’s an indicator of what Treasury security investors see for the future. By piling into longer-maturity bonds and driving down long-term interest rates, they’re signaling expectations of a deflationary, slow-growth period ahead.

Every recession of the past 50 years has been preceded by this upside-down state of interest rates. Thus, an inverted curve is a flashing red light that an economic contraction may be imminent.

To be fair, the inverted yield curve could be a false positive this time. (There have been a couple of those in recent decades too.) But what investor in their right mind is going to ignore it completely?

Unfortunately, Trump’s trade war with China and the general fear of recession don’t appear to be fading anytime soon.

If that’s not enough excitement for you, the Federal Reserve’s Open Market Committee will convene in Foggy Bottom in mid-September to consider another rate cut.

Markets expect a 25-basis-point cut (that’s a quarter of a percentage point), but many investors are hoping for 50 basis points. Trump has called for the Fed to slash its target interest rate by a full percentage point.

But Fed Chairman Jerome Powell has been cagey about whether the Fed will cut rates at the upcoming meeting at all. In a speech at Jackson Hole last month, he suggested he can’t use interest rate policy to undo the damage Trump’s trade war is doing to markets and the U.S. economy.

So while market expectations of further rate cuts are high, the reality of what the Fed will do is highly uncertain. As I tell my sons, happiness is the difference between expectations and reality. And when the former exceeds the latter, great unhappiness can result.

October promises even more volatility… and perhaps the scariest Halloween in years. October 31 is the day Britain will crash out of the European Union if a Brexit deal is not negotiated. And the way Prime Minister Boris Johnson is negotiating (he works a lot like Trump!), it looks like a no-deal Brexit is likely.

Predicting exactly what that will do to markets is a difficult task, but it probably won’t be pretty.

I ran all this by Chief Income Strategist Marc Lichtenfeld, who was hunkered down in his shuttered Florida home awaiting Hurricane Dorian when I spoke to him. “Is there anyone who doesn’t think things are going to be more volatile in the coming months?” he responded. “Volatility is increasing across a wide spectrum. The weather, geopolitics, Washington, the economy and certainly the market.”

It’s a bit unsettling, I must admit. I think I’ll go back to my tennis match…

Good investing,

Matt