Two Strong Triggers for Intercontinental Exchange

Would you like to invest – or perhaps even trade – a company that benefits from increased market volatility?

If so, then you’ll be very interested in today’s Trade of the Day on Intercontinental Exchange (NYSE: ICE).

Intercontinental Exchange operates regulated exchanges for commodity, financial, fixed-income, and equity markets in the United States, the United Kingdom, the European Union, Asia, Israel and Canada.

Its marketplaces for trading and clearing cover a vast array of asset classes, including energy and agricultural commodities, metals, interest rates, equities, credit derivatives, exchange-traded funds, bonds, and currencies.

In other words, the more people who trade, the better Intercontinental Exchange does.

And recently, given the increase in market volatility, it has had a strong year.

Intercontinental Exchange’s quarterly revenue growth (year over year) is up 11.8%, and its quarterly earnings growth (year over year) is up 15.5%. According to a recent volume release on November 5, these strong growth numbers are expected to continue.

For instance, in the month of October, Intercontinental Exchange reported that open interest (OI) on futures and options listings is up 8% year over year (and up 17% year over year from the end of 2018).

Specifically, in the energy sector…

- Oil OI is up 4% year over year.

- Other crude and refined products OI is up 13% year over year.

- Total natural gas OI is up 5% year over year.

In the agriculture and metals sector…

- Agriculture and metals OI is up 4% year over year.

- Sugar OI is up 4% year over year.

- Cocoa OI is up 13% year over year.

In the equities and interest rates sector…

- Total interest rate OI is up 16% year over year.

Can this strength continue?

I say yes for two reasons…

First, as we head into the close of the calendar year, I personally believe that market volatility will continue to increase…

But will we pull back from the historic highs we’re seeing right now (similar to what we witnessed last year at this time)?

Or will we continue to set new highs going into 2020?

Whatever happens, Intercontinental Exchange is positioned to win.

Second, Intercontinental Exchange just announced that it is partnering with Abu Dhabi National Oil Company (ADNOC) – and nine of the world’s largest energy traders – to launch ICE Futures Abu Dhabi.

This will create a new exchange in the Abu Dhabi Global Market that will host the world’s first “Murban” crude oil futures contracts (Murban is the ADNOC’s most plentiful oil grade, which accounts for about 1.7 million barrels a day – half of the crude pumped in the United Arab Emirates).

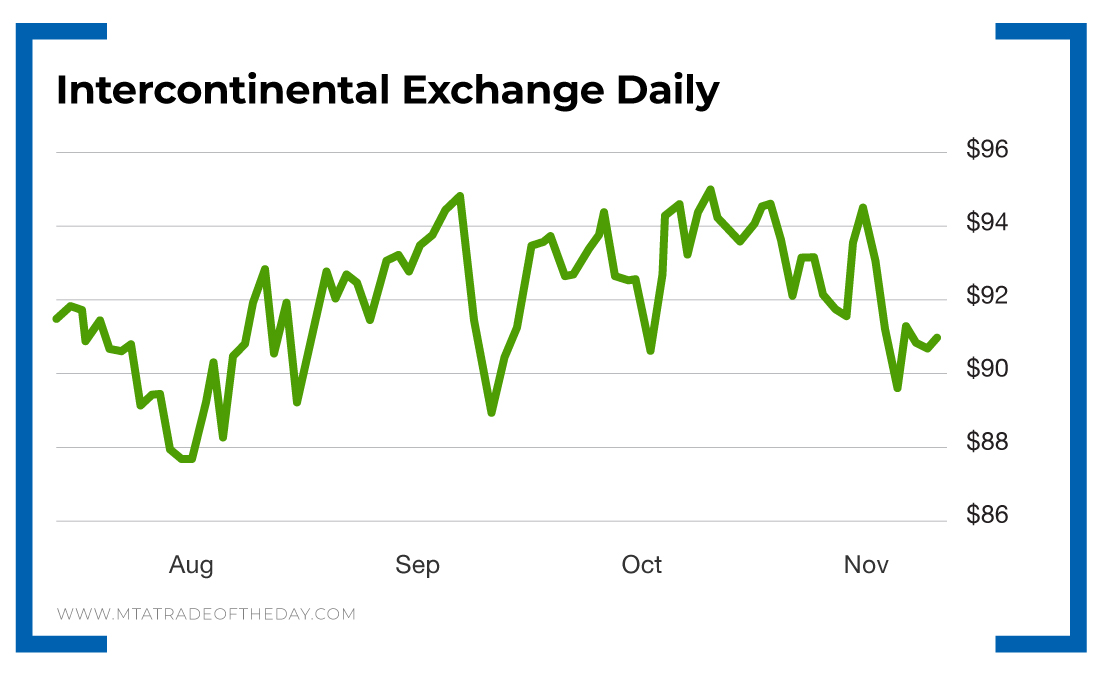

Action Plan: Add those two trigger catalysts together and buying Intercontinental Exchange anywhere between the support band that runs from $89 to $90 represents a strong entry opportunity.