Tesla Stock Forecast: Bullish. But Not For the Reason You Think

Tesla (TSLA) is one of the most fascinating companies in the world. This is mainly due to its dual status as both a revolutionary technology company and a meme stock. On one hand, Tesla is pioneering so many new technologies and is legitimately one of the best 6 non-FAANG stocks to hold for the next decade. But, on the other hand, you have Elon Musk selling short-shorts for $69.420 to mock investors who doubt the company. It just seems like a true banana republic over there at Tesla HQ.

Tesla’s stock was one of the biggest winners during 2020 and 2021, rising a staggering 1,000%. But, 2022 and 2023 were a bit less-than-stellar with Tesla losing roughly 50%. Heading into 2024, investors are trying to figure out what type of Tesla stock forecast to plan for. As for me, I’m bullish on Tesla. But, probably not for the reasons that you think.

Disclaimer: This article is for general informational and educational purposes only. It should not be construed as financial advice as the author, Ted Stavetski, is not a financial advisor.

Tesla (TSLA) Stock Forecast

Tesla has been on a tear over the past few years, reaching profitability much faster than many investors were expecting. But, the past few quarters haven’t been as rosy. Here’s how Tesla performed over the last three quarters:

- September 2023

-

-

- Revenue: $23.35 billion (+8% YoY)

- Net Income: $1.85 billion (-43% YoY)

-

- June 2023

-

-

- Revenue: $24.93 billion (+47% YoY)

- Net Income: $2.7 billion (+20% YoY)

-

- March 2023

-

- Revenue: $23.33 billion (+24% YoY)

- Net Income: $2.51 billion (-24% YoY)

Revenue growth has become a bit stagnated recently, and CEO Elon Musk has even resorted to slashing prices on certain EV models to increase sales. These price cuts have been in response to increased competition from legacy automakers as well as Chinese EV companies. For years, Tesla enjoyed a unique position as the world’s only major electric vehicle company. But, those days are rapidly coming to an end as virtually every single automaker now produces several lines of EVs.

As far as whether or not Tesla stock is overpriced, Tesla currently has a price-to-earnings ratio of just 42. While this is significantly higher than most automakers, it really isn’t that much for a tech company. Either way, I don’t want to spend too much of this Tesla stock forecast talking about EVs because I don’t think that will be the main driver for TSLA stock moving forward.

Tesla’s Future isn’t EVs

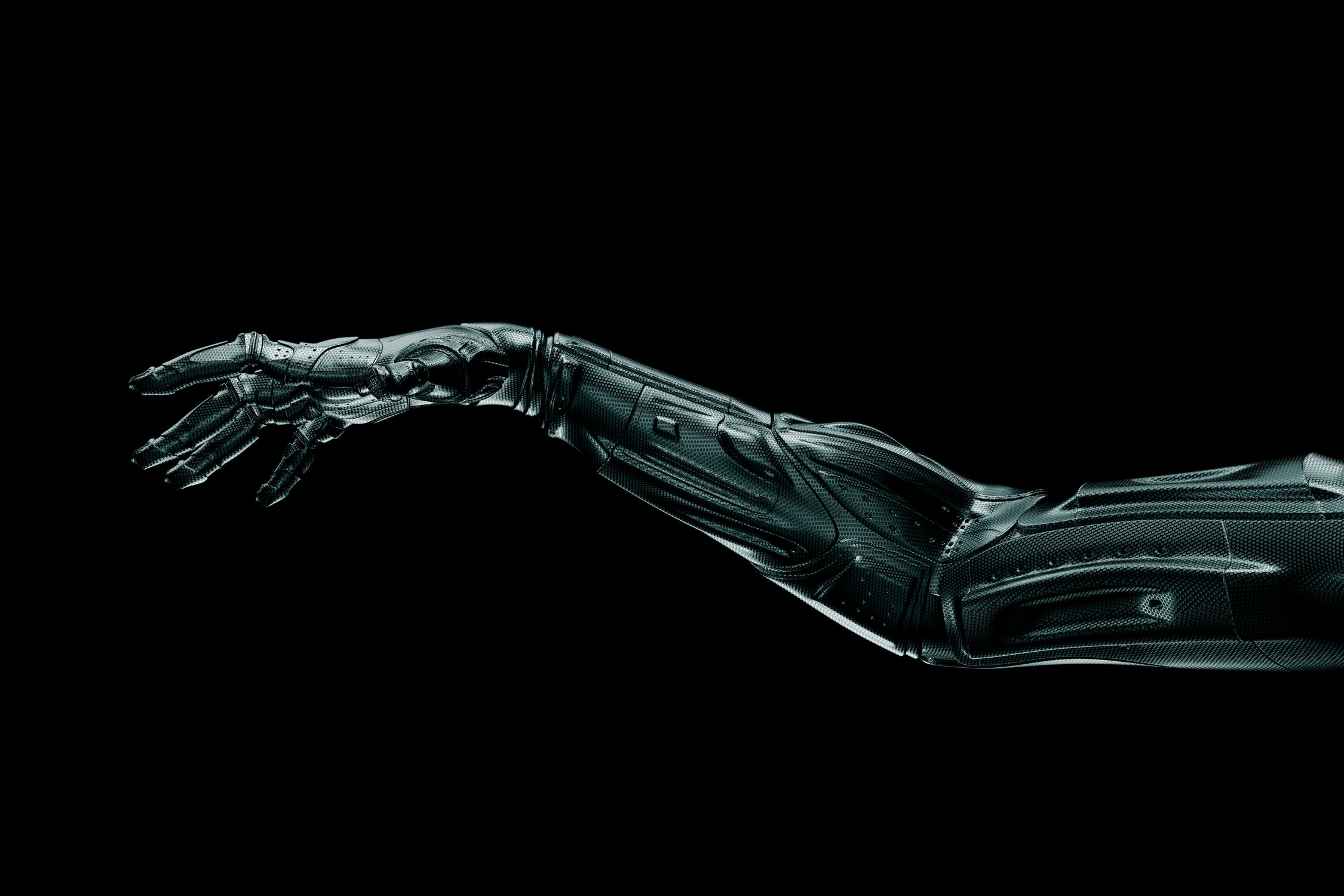

The future of Tesla isn’t EVs – it’s robots.

Investors have always viewed Tesla as a technology company first and a carmaker second. After all, Teslas are essentially just computers on wheels. This mentality of investors to treat Tesla as a tech company is what has allowed the company to command such high valuations in the past.

If Tesla was “just a car company” then it wouldn’t trade at 50X earnings (and even higher in the past).

Right now, Tesla is working on a new product that’s gotten a surprisingly quiet reception: the Optimus humanoid robot. If you haven’t already seen videos of Tesla’s Generation 2 Optimus then quickly watch this 2-minute-long video. It looks like a prequel to “I, Robot.” If you haven’t seen I, Robot, it’s an old Will Smith movie where humans live alongside robots.

Now, most people reading this Tesla stock forecast will probably scoff and assume that this tech is at least a decade or two down the road. It isn’t. There’s a very good chance that Tesla’s humanoid business will eclipse its EV business in the few few years.

Musk’s Comments

The Optimus is still a prototype. As such, it didn’t get a lot of screen time during Tesla’s last earnings call in January. But, CEO Elon Musk had this to say about Optimus:

“Optimus obviously is a very new product, an extremely revolutionary product. It’s something that I think has the potential to far exceed the value of everything else that Tesla combined.”

Elon Musk has been known to hype up Tesla products in the past. But, this is still high praise coming from the company’s CEO.

Tesla’s Advantage

As far as competing in the humanoid market, one major thing that sets Tesla apart is its manufacturing capability. This will help Tesla compete (and beat) other robotics companies, like Boston Dynamics for example.

Tesla is already one of the biggest car manufacturers in the world and delivered 1.81 million cars in 2023. At the same time, it has AI capabilities from developing cars that can translate over to developing humanoids. In fact, Tesla actually uses the same AI inference technology for both cars and robotics (according to Musk on Tesla’s last earnings call).

Finally, Tesla has the capital-raising ability to help scale the humanoid technology once it’s ready. Honestly, Musk could probably pay for it all himself if he really wanted to.

Monetizing Humanoids

So, yes, Tesla might be at the forefront of the humanoid revolution. But, how will this turn into profit for EV manufacturers? Well, humanoids are clearly an emerging technology which means that there isn’t a set use case just yet. But, the possibilities are nearly limitless. Tesla designed Optimus to fit smoothly into human society. With this in mind, you could theoretically swap in an Optimus into whatever tasks a human could do. Here are a few examples:

- Licensing humanoids to manufacturing companies for use in factories

- Selling or renting them to consumers for use in the home

- Using humanoids for manual, repetitive tasks (yes, this likely means replacing human workers at places like fast food restaurants or delivery companies).

As far as the timeline for when humanoids will be released, it’s tough to say. But, I have a feeling that it will be much closer than investors think, considering where the tech is at now and how fast AI is accelerating. Additionally, it doesn’t necessarily matter when Tesla starts profiting from these robots. All that matters is the hype cycle that leads up to the robots. Once the hype starts to build, investors will start to pull projected earnings forward.

The Elephant in the Room

One concern for Tesla shareholders is the company’s erratic CEO: Elon Musk. Five years ago, having Musk at the helm was an undeniable tailwind for the company. In the past, Musk’s behavior was likened to that of a “crazy genius” like Tony Stark. But, Musk’s behavior has felt a bit more “crazy” than “genius” lately. When writing any Tesla stock forecast, Musk is definitely a risk factor worth mentioning.

Here’s a quick history of Elon Musk’s questionable decision-making over the past few years:

- April 2022: He bought Twitter for $46 billion – overpaying by several billion dollars.

- After buying the company, he publicly fired 80% of Twitter’s workforce, while also stripping out content moderation protections.

- November 2023: Told advertisers, including Disney CEO Bog Iger, to go f*ck themselves.

- December 2023: Fidelity marked down the value of Twitter by roughly 70%.

- Jan 2024: Musk demanded that Tesla’s board gives him 25% of the company (worth roughly $80 billion).

So, what happens if Musk starts acting similarly at Tesla? If the board refuses to give him more shares, will he hold a press conference and tell the board to go f*ck themselves? Will he lay off any engineer who disagrees with him? Will he crash the value of Tesla by 70% with shoddy decision-making? These questions sound absurd. But, he’s done all of these things with Twitter – so why not Tesla?

There’s also the fact that Elon Musk currently runs six different companies: Tesla, SpaceX, xAI, The Boring Company, Neuralink, and X (Twitter). No person can realistically work six different jobs, which calls into question his capabilities as a CEO.

For years, Elon Musk was Tesla’s biggest asset. But, he might be turning into its biggest liability. If Tesla can leverage the “genius” side of Elon Musk and mitigate the “crazy” then the future looks bright for this growing humanoid company.

I hope that you’ve found this Tesla stock forecast valuable in learning whether or not Nvidia is overvalued. If you’re interested in reading similar articles, be sure to subscribe below to get alerted of new articles from InvestmentU.