What is Stock Capitulation?

In the event of a broad stock market downturn, many investors find themselves wondering if they should sell a losing position. They see the price continuing to fall and they get nervous, eventually selling as a reaction to the stock’s performance. Unfortunately, for other investors still holding that particular stock, this groupthink tends to send the share price plummeting. It’s a phenomenon known as stock capitulation.

Stock capitulation occurs often in bearish and down-trending markets. It’s a psychological phenomenon that’s often seen as irrational and emotion-driven—hence its other name: panic selling. Here’s what stock capitulation looks like in action, and how to handle it if you’re one of the stalwart investors holding a stock that others are eagerly selling off.

Recognizing Stock Capitulation

The word “capitulation” is actually a wartime term, meaning “to surrender” or “to cease resistance.” It’s an apt description of what happens during an instance of stock capitulation within a struggling market. The situation goes something like this:

A stock might fall 5% over the course of a month, then continue to fall another 10% in the following month. This short-term 15% drop will put many recent investors underwater in their position. Rather than lose more on a stock that looks set to fall further, they capitulate and sell. Selling pushes the price lower, which quickly pushes other investors to sell. The price falls further, erasing gains and creating losses for those still holding the stock.

The hallmark of stock capitulation is a rapid sell-off, resulting in a 10% decline within a single trading period. High trading volume is a natural factor as well, created by the rush of many investors to exit their position.

Examples of Stock Capitulation

In 2022, we’ve already seen several instances of stock capitulation. Meta Platforms (NASDAQ: FB) dropped more than 25% overnight in early February. Netflix (NASDAQ: NFLX) plummeted 35% one day in April. Tesla (NASDAQ: TSLA) and Amazon (NASDAQ: AMZN) both dropped more than 10% over a single trading period in April.

Capitulation Traps and Cognitive Bias

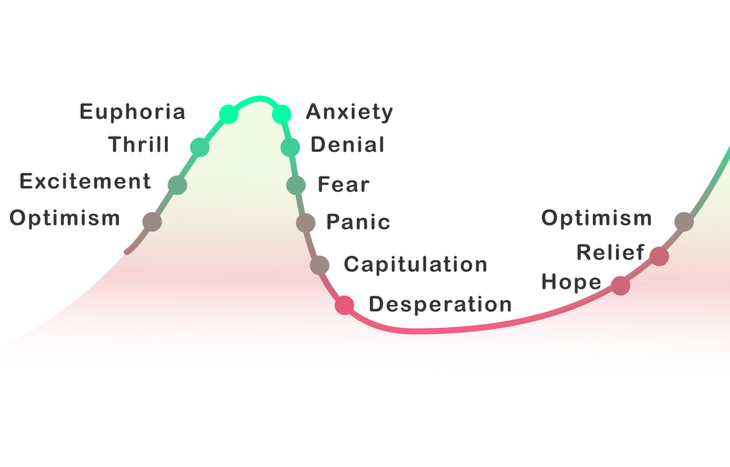

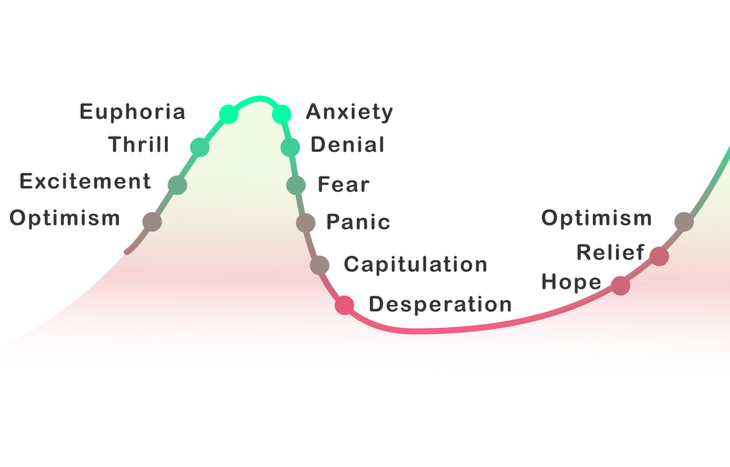

Stock capitulation is the result of emotion-driven decision-making. Investors see a falling stock and rush to exit their position, which inevitably drives the price lower, causing more investors to do the same. It’s the opposite of FOMO investing, which sees investors rushing to get in on a rising stock price.

Like FOMO, capitulation represents a cognitive bias that tricks investors. Investors see the price falling and assume they should also sell, lest they end up holding the bag. However, there might not be a viable reason for the plummeting share price and more often than not, capitulation is the result of an overreaction to minor fears that snowball into major sell-offs.

In down-trending or bearish markets, capitulation traps are common. Investors see the broader market struggling and assume that even a slight downturn in a stock is the beginning of a precipitous fall. They rush to exit their position before it goes further, triggering panic selling that’s ultimately a self-fulfilling prophecy. This creates hindsight bias, which can perpetuate other instances of stock capitulation.

In simpler terms: panic selling has a tendency to create more panic, which leads to other instances of stock capitulation that drive markets down.

Stock Capitulation Could Signal an Entry Opportunity

One of Warren Buffett’s most-cited pieces of wisdom is to “be fearful when others are greedy and be greedy when others are fearful.” This adage is often applied to instances of stock capitulation.

There’s a commonly held theory that instances of capitulation signal a price bottom, because those left holding shares after a massive sell-off are the most risk-tolerant investors. The price is unlikely to go lower, which represents a buying opportunity. Post-capitulation is theoretically the floor of the stock price, and it’s often much lower than recent floors. Value investors tend to look closely at recent sell-offs for this specific reason.

While stock capitulation could indeed signal a great entry point for a promising stock, it’s by no means a sure thing. Sometimes, over-eager investors enter a position only to see the stock fall lower as stragglers seek to sell on the bounce. Short sellers can also stunt a stock’s recovery after capitulation. It’s often best to wait several trading periods for the price to rebound several percent before opening a position. Pay close attention to trading volume as well.

What Does Capitulation Mean for Savvy Investors?

Stock capitulations are tricky to navigate. For starters, they’re typically defined in hindsight, which makes it difficult to preempt them or brace for them. There’s also no telling if a capitulation event is a true bottom, or if the stock will continue to fall on bearish sentiment.

The best way to navigate rapid sell-off and profound price depreciation is to be rational where others are emotional. Fundamentally evaluate the stock and determine if your investment thesis is still valid. Then, decide whether you want to buy, sell or hold, and to what degree. Remember that capitulations tend to open the door for buyers seeking value. So it’s often smart to wait for several trading periods before making your decision. See how the stock behaves before reacting.

It’s also smart to stay apprised of stocks after capitulation takes place. Subscribe to one of the best investment newsletters for insights about stocks suffering duress and massive sell-offs, to determine if it’s a value play waiting to happen or a stock that still has further to fall.