Peloton and Twitter – Two Earnings Plays to Watch Immediately

Two companies are set to report earnings – and I believe both are primed for a big move.

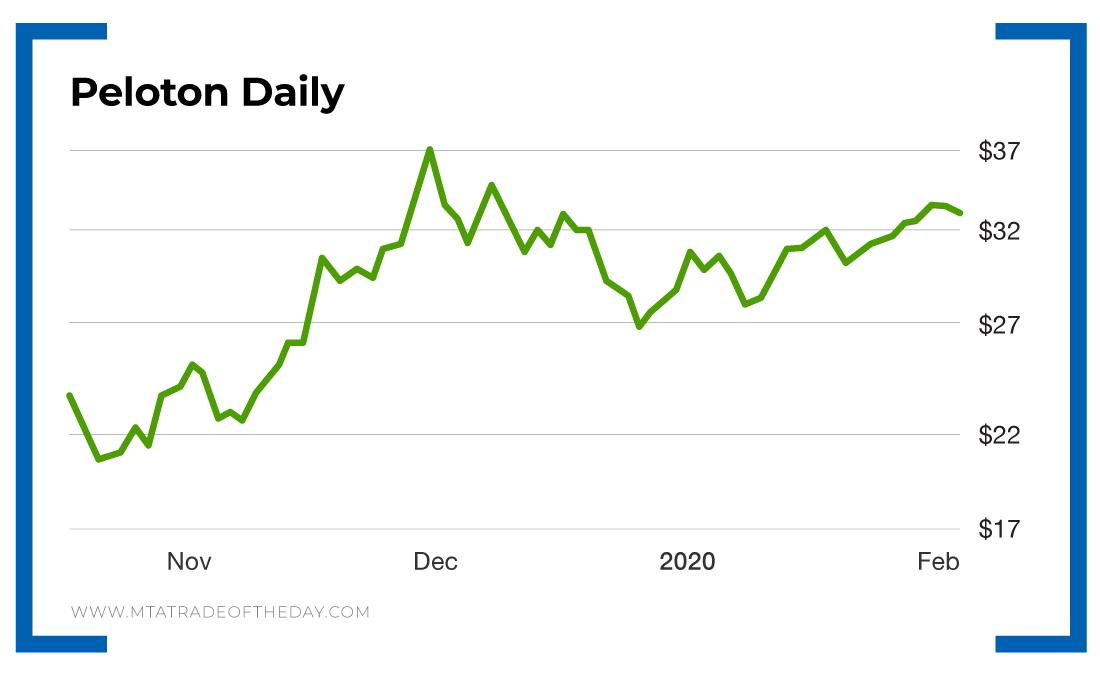

By the time you read this Trade of the Day issue, the first company will already have reported. And that company is Peloton (Nasdaq: PTON).

Going into the report, Peloton has been quite polarizing. Its 2019 sales growth is currently 110.3% – and Wall Street loves rewarding growth with a huge price premium. But on the other hand, Peloton was just downgraded by Bank of Montreal Capital Markets (before market open) with a $27 price target.

Even more dramatic, Citron Research set a $5 price target on Peloton, saying, “Unless Peloton invents a piece of equipment that works out for you – this is going to $5.”

Going into the earnings report, Peloton is expected to report earnings per share (EPS) of negative $0.32 on revenue of $423.45 million.

Will Peloton gap up or gap down tomorrow?

Is it a $5 stock… or a $50 stock?

This will certainly be worth tracking first thing in the morning.

The second company set to report earnings before the market open tomorrow is Twitter (NYSE: TWTR).

Over its last three earnings reports, Twitter has moved 21% lower, 5% lower and 14% higher. So clearly, this name makes tradable moves.

Going into the report, the expectation is that Twitter will report EPS of $0.28 on revenue of $997.35 million.

Will Twitter gap up or gap down tomorrow morning?

We’ll certainly be tracking and trading it in The War Room.

Action Plan: If you want to follow along, then pull up Peloton and Twitter tomorrow morning – and track the magnitude of each earnings move.

If you’d like to start trading these moves using our unique earnings methodology, then I invite you to join me in The War Room! And explore our newest presentation by clicking here!