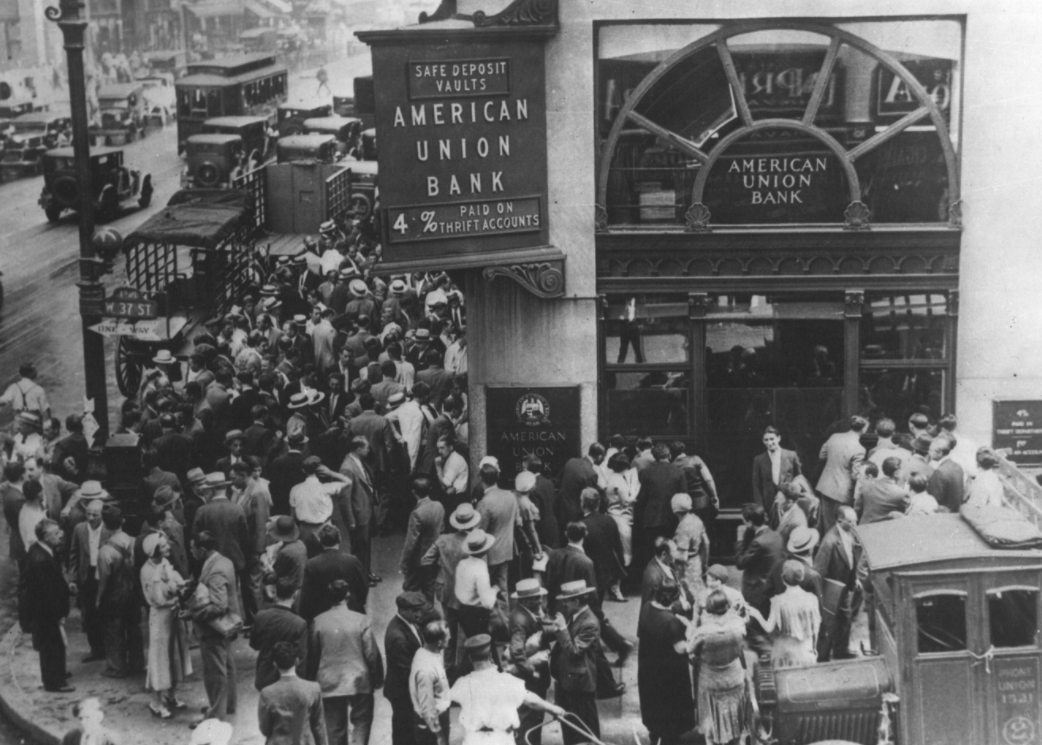

Buying When There’s Blood in the Streets

Financial market legend and 19th-century banker Nathan Rothschild once allegedly declared…

“The time to buy is when there’s blood in the streets.”

As the story goes, Rothschild used this contrarian approach to amass a fortune.

This memorable quote has been circulating in investment circles since the 19th century, inspiring generations of contrarian-minded investors.

One of the most famous and successful of these investors is Warren Buffett. But several years before Buffett started making a name – and a fortune – for himself, a guy named John Templeton was playing an unusual form of contrarian investing.

In 1939, at the outbreak of World War II, the 26-year-old Templeton borrowed money to buy 100 shares of every stock trading below $1 on the New York and American stock exchanges. Templeton picked up shares in 104 companies, 34 of which were in some form of bankruptcy proceedings. Four years later, Templeton cashed out… but not before quadrupling his money.

Templeton’s quirky investment idea exemplified a contrarian approach that would blossom into an enormously successful investment management business.

Recognizing the demonstrable power of contrarian investing, we devised the “Blood in the Streets” (or BITS) strategy. It identifies just one investment per year based on the trailing three-year performance of eight specific stock market indexes and commodity sectors. We call them the “Impactful Eight,” and we’ll list them further down in this article.

Here’s how to implement the strategy…

Monitor the trailing three-year total returns of each member of the Impactful Eight.

Rank them from “worst performing” to “best performing.”

One time each year, on the final trading day of the year, invest in the worst performer of the prior three years.

Hold that investment for the following two years.

There is one final wrinkle…

Since the strategy requires one new investment per year but then requires holding that investment for two years, an investor has to hold two investments each year. But at the end of each year, the investor replaces one of those holdings.

Here are the actual foreign stock and commodity sectors the strategy uses…

This group may seem random or arbitrary, but it isn’t. These eight sectors have demonstrated a relatively low or inverse correlation with one another. In other words, they tend to go through their particular cycles of highs and lows at different times.

Therefore, by continually investing in the Impactful Eight sectors that are lagging behind the others, you invest in the foreign indexes or commodity plays that are closer to making a low than a high.

During the 21 years from the end of 1995 through the end of 2016, the BITS strategy produced a cumulative total return that was more than four times the 430.6% total return that the S&P 500 Index delivered over the same time frame.

These results are so successful that many folks find them hard to believe. And that’s very understandable. These results are hard to believe… at least until you realize that they’re consistent with the successes that numerous contrarian strategies have achieved.

Bottom line: Buying low works much better than buying high.

However, as successful as the BITS strategy has been during the last 20 years, most individual investors could not have used it. It was available only to professional investors or sophisticated high net worth individuals.

That’s because, during the last 20 years, there weren’t always funds in existence that accurately tracked the investment performance of each index or commodity sector in the Impactful Eight.

Fortunately, those days are over. This strategy is now very easy to implement.

Bit by bit over the last two decades, a variety of exchange-traded funds (ETFs), exchange-traded notes (ETNs) and other funds have come to market that provide exposure to specific foreign markets and commodities.

The table below shows the exact funds BITS uses as proxies for the Impactful Eight indexes – which form the core of our strategy that has been so successful since 1995.

Obviously, this very simple strategy is not the only way to pursue a disciplined contrarian approach to investing. Outstanding investment opportunities present themselves throughout the year – not just on the last day of it.

Good investing,

Eric

*The views and opinions expressed in this article are those of the author and do not necessarily reflect the official position of Wall Street analysts.