Miss Tesla’s Pop? Catch Up Immediately With One Click

In the spirit of full disclosure…

I drive a Tesla Model S, but I do not own Tesla (Nasdaq: TSLA) stock.

However, while shares of Tesla were exploding over the last few weeks, I was smiling.

Why?

Because I was still exposed to the explosive upside move using a cheap backdoor way to capitalize on the Tesla move – all for a fraction of the price.

And today I’m going to share this little gem with you.

Without exaggeration, this may be the most important Trade of the Day issue you’ll ever read – so please give me five minutes of your time so you can see what I’m about to reveal to you.

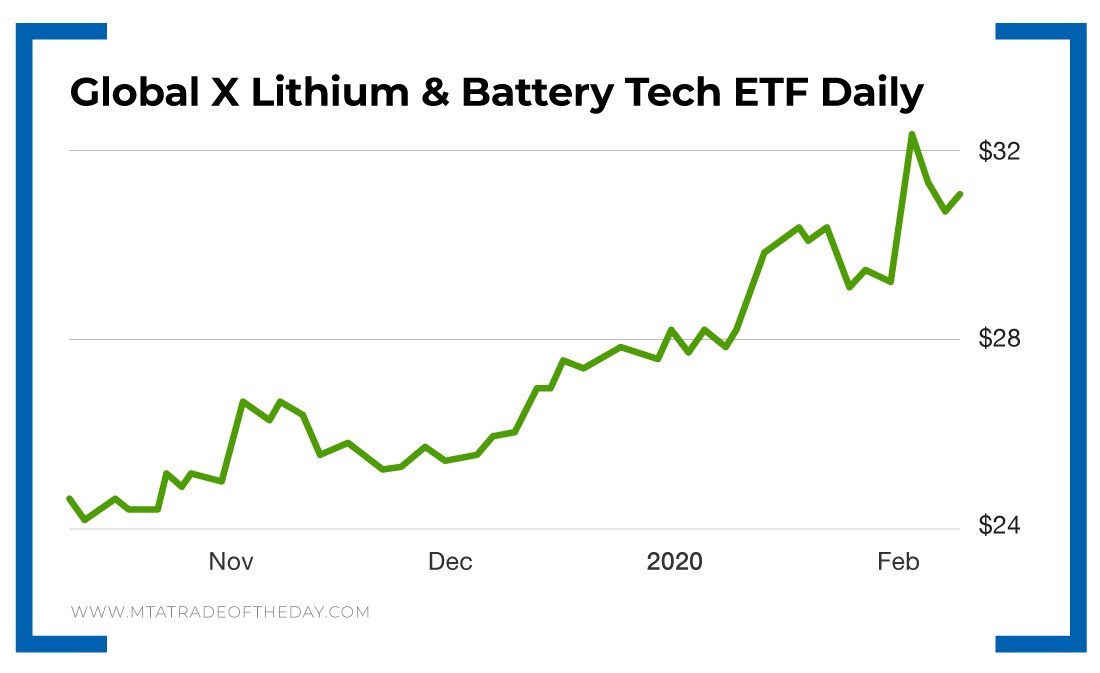

The investment I highly recommend making immediately is the Global X Lithium & Battery Tech ETF (NYSE: LIT).

It’s up 9.2% in 2020 and offers you exposure to many securities representing the full lithium cycle, from mining and refining the metal all the way through battery production.

Simply put, it’s a nondiversified way for you to have complete coverage of the market performance of global companies involved within the entire lithium industry.

Why is this so important?

Well, lithium is a soft, silvery-white alkali metal. It’s the lightest metal and a solid element. Like all alkali metals, lithium is highly reactive and flammable. And because of its relative nuclear instability, lithium is less common in the solar system than 25 of the first 32 chemical elements.

When it comes to industrial applications, lithium-ion batteries are essential for the rapid growth of electric vehicles.

In other words, the clean energy economy is here. It’s not going away. And the Global X Lithium & Battery Tech ETF gives you complete coverage to every single company that’s essential to making it happen.

For instance, Michael Bloomberg wants all new cars to be electric-driven by 2035 – and 15% of American trucks and buses to be pollution-free by 2030.

Now here’s the secret…

Look at the top 10 holdings in the Global X Lithium & Battery Tech ETF:

- Albemarle Corp.

- Sociedad Química y Minera de Chile

- Tesla

- Livent

- Samsung SDI

- Panasonic

- Simplo Technology

- GS Yuasa

- BYD

- LG Chem.

Notice how Tesla is in there?

It represents 9% of the entire Global X Lithium & Battery Tech ETF basket.

So if you missed the move on Tesla but you’d still like to have exposure to the stock, then this is a play that should be part of your core portfolio – starting today.

ActionPlan: A post on a Global X Lithium & Battery Tech ETF forum said, “Stay Long on this one. 18-24 months. Rewards will be huge given what the automobile industry is moving towards.”

I couldn’t agree more.

For more trade ideas like this and real-time trading instructions, join me in The War Room today!