Meta Materials Stock: Is Now a Good Time to Buy?

As of late, Meta Materials stock has been on the rise. Many investors like this company because of its unique product offerings. Meta Materials specializes in creating unique materials that have a variety of applications. Some of Meta Material’s (Nasdaq: MMAT) products include meta-air. Which, is eyewear specifically made for pilots.

GlucoWISE is another revolutionary product. And this dips into the biotech area. It allows people with diabetes to track their glucose levels. And all without having to prick their finger.

This is a really incredible product for Meta Materials. Because it has the potential to help a lot of people manage their diabetes better. And, it could also lead to Meta Materials being seen as a more compassionate company.

That said, GlucoWISE is still in development. So, there are some risks with Meta Materials stock. But, if the product is successful, it could be a huge win for the company.

Overall, Meta Materials is an interesting company with a lot of potential. Investors should do their own research before investing. But, Meta Materials could be a good long-term investment. With so many innovative products, it is no wonder that Meta Materials stock is doing so well.

About Meta Materials

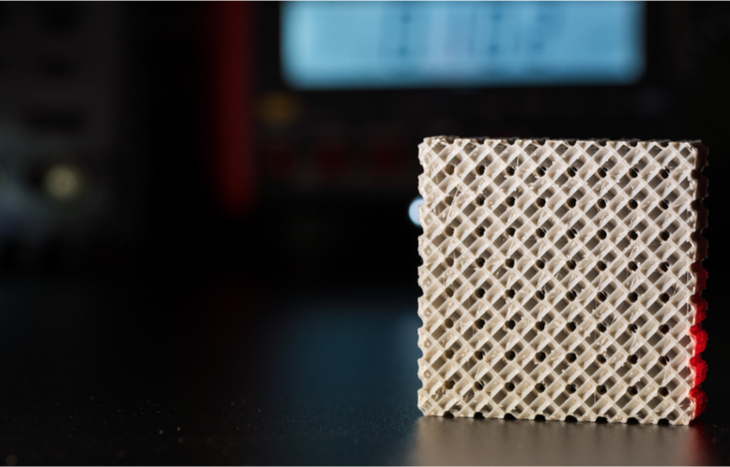

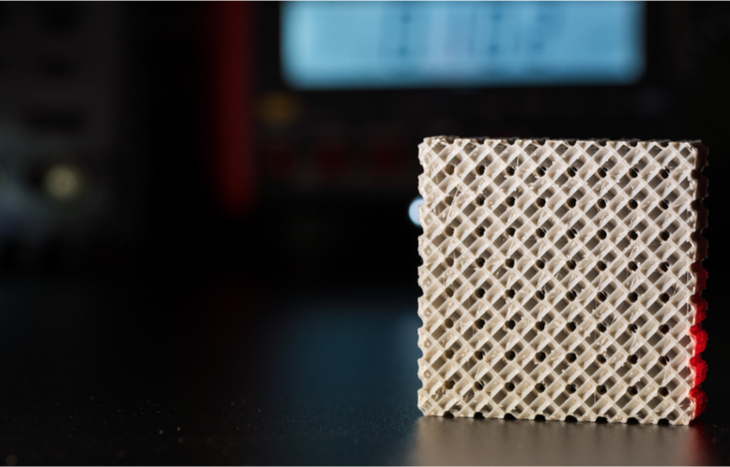

Meta Materials is a company that produces products not found in nature. And the reason Meta Materials is such a large company? Because they have many products that can be used across various industries. Some of these products include solar cells, touch screens, and laser glare protection. Also, synthetic metals, glass, and coatings. Meta Materials is constantly innovating and coming out with new products. They are a company to watch in the future.

Meta Materials stock has been on the rise lately. Many investors are interested in this company because they offer unique product offerings.

It is headquartered in Dartmouth, Canada, and was founded in 2007. Meta Materials went public in 2010 and they trade on the Nasdaq under the ticker symbol MMAT. Meta Materials has a market cap of $469 million as of May 2022. Investors interested in Meta Materials should do their own research before investing though.

Metamaterials have many uses and this is a leading company in its field. They are constantly innovating and producing new ways to use these materials. This is why their stock price is so high. But, there is always the potential for Meta to come up with a new product. One that is even better than their current products. This could lead to an increase in its stock price.

Meta Materials Stock Earnings

Total revenue for 2021 was $4 million, up from $1.1 million in 2020. That’s a 264% increase year-over-year (YOY). And, so far, 2022 Q1 has seen $2.9 million so far.

As of right now, Meta Materials stock has a market cap of $482 million. Their 52-week high stock price was $19.84 and their 52 week low was $1.17.

And, it has been on quite the roller coaster ride throughout the life of the stock. But, sometimes it peaks. And recently in 2021, we saw one of those huge multibagger peaks. Now, it has come back down to correct itself. And it’s only a matter of time before it spikes up again.

Stock News

Meta Materials has been in the news a lot lately. And, most of it has been good news. They recently announced that they have partnered with a company called GlucoWise.

This partnership will allow Meta Materials stock to create a specific product. One that will help people with diabetes to monitor their glucose levels. And, it will let them do this without having to prick their finger. And they’ve even received their first granted U.S. patent for this.

Plus, they’ve been attending investor conferences recently. This is a great sign because it shows their interest in growing the company. The company also recently appointed a new Chief Marketing Officer.

Meta Materials’ Stock Industries

Meta Materials is a leading provider of nano-enhanced materials. Varies industries use the company’s products. Including electronics, automotive, aerospace, and defense. Their nanotechnology is also used to develop new and innovative products. Specifically in the fields of energy, healthcare and consumer goods. Plus, the company is dipping its toes into the 5G and energy sectors.

Meta Materials Stock Forecast

Meta Materials is a leading provider of nano-enhanced materials. The company’s products and nanotechnologies are used in a variety of industries. They are constantly innovating and coming up with new products. Meta Materials is a company to watch in the future.

The company’s strong recent performance has driven Meta Materials stock to new highs. And it looks to continue its growth in the coming years. Especially as it brings its cutting-edge technology to more industries and customers. And they’re going to do this all around the world.

Is Meta Materials Stock a Good Buy?

Meta Materials has seen its stock price increase sharply in recent months. Especially as investors bet on the company’s future success. Meta materials have many potential applications. And the company is in a good position to capitalize on this growing market. Meta Materials also has a strong balance sheet, with no debt and plenty of cash on hand.

However, Meta Materials is still a pretty small company. And its stock price may be too oversold for some investors. And they also face stiff competition from other companies in the space.

Overall, Meta Materials looks like a solid investment for long-term growth. But, investors should be aware of the risks with investing in a small company. Meta Materials stock is not suitable for everyone, however, it could be a good addition to a diversified portfolio.

Final Thoughts

Meta Materials stock has seen some nice new highs in recent years. And this is in direct relation to its great performance. And now, the stock has corrected a lot. Meta Materials is set to continue its growth especially as it brings its cutting-edge technology to more industries and customers around the world.