Investing in Precious Metals: A Beginner’s Guide

Investing in precious metals is not a new concept. When it comes to investing, there are many different options available. One option that has been around for centuries is investing in precious metals. Precious metals include gold, silver, and platinum. And they can be a fantastic way to diversify your investment portfolio. So here are some things to consider if you’re thinking about investing in precious metals…

Considerations when Investing in Precious Metals

It’s important to consider what type of precious metal you want to invest in. Gold is the most popular choice, but silver and platinum are also viable options. Each metal has its own benefits and drawbacks, so do your research before deciding.

Once you’ve decided on a metal, you need to decide how you’re going to invest in it. There are a few different options available. Including investing in physical metal, mutual funds or ETFs that track precious metals. Or investing in stocks of companies that mine or deal in precious metals.

Investing in mutual funds or ETFs can be a more cost-effective way to invest in precious metals. These options give you exposure to a variety of different metals. Which can help mitigate some of the risks associated with investing in just one metal.

Finally, investing in stocks of companies that mine or deal in precious metals can also be a good option. This type of investing can offer both growth and income potential. As well as the opportunity to invest in companies that you’re familiar with.

When it comes to investing in precious metals, there are a variety of options available. Consider your goals and objectives carefully before planning. And consult with a financial advisor if you have any questions. So, conduct careful planning and research. Because investing in precious metals can be a great way to achieve your financial goals.

Investing in Precious Metals vs. Stocks

Precious metals have been used as a form of currency and investment for centuries. Stocks can be subject to wild fluctuations. So, investing in precious metals is a more stable way to grow wealth. Here are some reasons why investing in precious metals may be a better choice than stocks:

- Precious metals are a finite resource, whereas stocks can be created or destroyed at any time. This makes precious metals a more reliable investment over the long term.

- Precious metals are not subject to the same volatility as stocks. The stock market can experience sudden drops. But precious metals tend to hold their value much better.

- You can physically own precious metals, unlike stocks which are just pieces of paper. This gives you more control over your investment. And it allows you to avoid the fees associated with buying and selling stocks.

Benefits of Investing in Precious Metals

Gold has maintained its purchasing power throughout history. Even in times of inflation.

Investing in precious metals is a great way to hedge against economic uncertainty. And to protect your wealth. Here are some of the key benefits of investing in precious metals:

Precious metals are a safe haven asset. When markets are volatile, or the economy is struggling? Investors often turn to safe haven assets. Like gold and silver. This is because precious metals are seen as a reliable store of value and a hedge against inflation.

Precious metals can provide diversification. It can help to diversify your investment portfolio. And reduce your risk. This is because precious metals tend to move independently of other asset classes. Such as stocks and bonds.

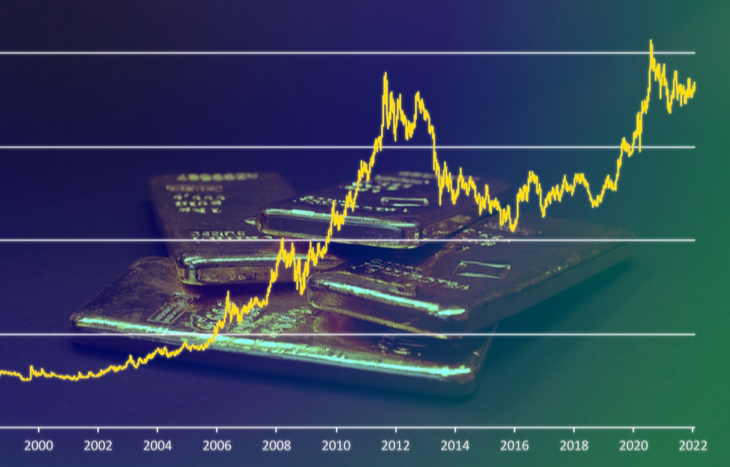

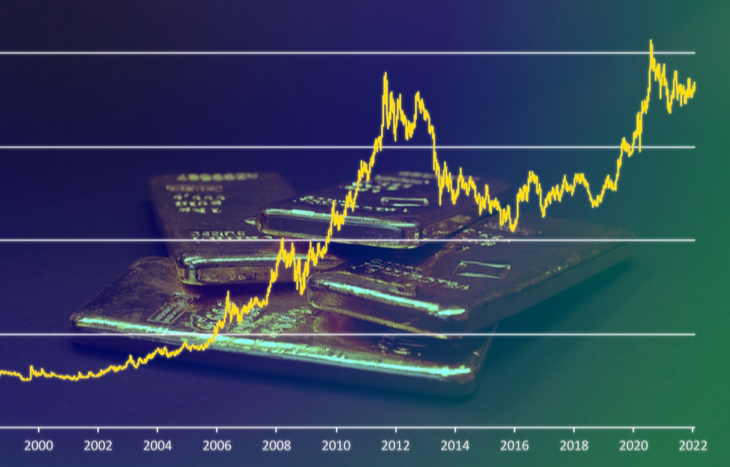

Precious metals offer potential for capital gains. While the price of gold can be volatile in the short-term, it has tended to rise over the long term. This means that investing in gold could offer you the potential for capital gains.

Types of Precious Metals to Invest In

Investing in precious metals are a popular choice for investment. Because they offer both stability and growth potential. While there are many different precious metals to choose, some are more widely traded. And they’re easier to find than others. Here is a look at four of the most popular precious metals to invest in:

Gold

Gold is the most popular way, and it has been used as a store of value for centuries. It’s abundant enough that coins can be produced. But it is also rare enough so that it can only be produced selectively. The gold market is very liquid, making it easy to buy and sell gold investments.

Gold is often considered a safe haven asset. Which means that investors tend to buy gold. Especially when other assets are experiencing volatile markets. This can help to protect your investment portfolio from losses. especially during a market downturn.

Silver

Silver is another popular precious metal for investment. And it has a long history of being used as currency. Silver is less abundant than gold, which makes it more difficult to produce coins. But, silver bullion bars and rounds are readily available from bullion dealers.

Silver prices tend to be more volatile than gold prices. Which means that silver can offer greater potential for price appreciation. However, this also means that there is more risk involved in investing in silver.

Platinum

Surprisingly, buying platinum is a wonderful way to be investing in precious metals. And, it’s often used in jewelry and industrial applications. Platinum is much rarer than gold or silver, which makes it more difficult to find and buy.. Platinum bullion bars are available from some dealers. But they can be quite expensive.

Because platinum is so rare, it is often considered a collector’s item. As such, investing in platinum can be an effective way to diversify your investment portfolio. But, due to its rarity, platinum can be a volatile investment. So, it is important to do your research before investing.

How to Invest in Precious Metals

There are several ways to be investing in precious metals. Including buying physical metals, investing in ETFs or mutual funds. Or even investing in mining stocks.

No. 3 Buy Physical Metals

One of the most direct ways to invest is to buy the physical metals. You can buy these metals through a dealer or broker, or even directly from some mints.

When buying physical metals, it’s important to consider storage costs. And security risks. You may want to store your metals in a safety deposit box at a bank. Or with a private storage company. And, if you plan on investing in precious metals in copious quantities? It may be more cost effective to buy through a dealer that offers discounts for bulk purchases.

No. 2 Invest in ETFs or Mutual Funds

You might be looking for a more hands-off approach to investing in precious metals. You can invest in exchange-traded funds (ETFs) or mutual funds that hold these assets. These funds are traded on major exchanges and can be bought and sold like stocks.

But, it’s important to note that most ETFs and mutual funds are not pure plays. That is, they hold a mix of stocks and bonds in addition to metals. As such, their performance will be influenced by factors beyond the price movements of gold, silver, platinum or palladium.

No. 1 Invest in Mining Stocks

Buy stocks of companies involved in mining and extracting these metals. This can be a more speculative approach. Because the success of these companies depends on many factors. Factors beyond the price of gold, silver, platinum, or palladium.

Still, for those willing to take on this extra risk, investing in mining stocks can provide exposure to precious metals. All without having to buy the physical assets themselves.

No matter which approach you take, it can be lucrative. And a terrific way to diversify your portfolio. All while protecting yourself against potential economic uncertainty.