Investing in Gold and Silver

Investing in gold and silver has long been a way to hedge against stock market turbulence. These precious metals have been commodities since the beginning of human civilization. And while they no longer back currency, they’re nonetheless lucrative investments in and of themselves.

If you’re enticed by the splendor of gold and silver, you’ll enjoy knowing that there are more than a few ways to invest in these assets. Whether it’s through commodity indexes or ETFs – or even bullion – getting your hands on precious metals isn’t as difficult as you might think. Here’s a look at how to make gold and silver part of your investing strategy.

Different Ways to Invest in Gold and Silver

There’s a literal wealth of possibilities when it comes to gold and silver investment vehicles. Here’s a look at how you can tap into the lucrative opportunities of these age-old commodities:

- ETFs: There are plenty of precious metals ETFs out there. The iShares Gold Trust (NYSE: IUA) and iShares Silver Trust (NYSE: SLV) will give you exposure to the commodities themselves. Or you can bring them both into a single investment with an ETF like Aberdeen Standard Physical Precious Metals (NYSE: GLTR). There are dozens of ETFs that grant you access to physical silver and gold, as well as companies that handle them.

- Bullion: Prefer the authentic commodity? Prepping for the end of days? Whatever your reason for wanting to own gold and silver, bullion allows you to tangibly own these precious metals. It’s easy enough to get your hands on them, but you’ll need a safe place to store them. Plus, they won’t appreciate like stocks will; instead, they’re governed by spot prices.

- Certificates: Certificates are adjacent to owning the physical metals themselves. A certificate says that you own bullion stored safely off-site, usually by a broker. It’s a lot easier to manage a piece of paper, but you’re still dealing with the drawbacks of handling a physical asset.

- Common stock: There are plenty of stocks out there that’ll give you exposure to gold and silver. From mining companies and streamers to smelters and brokers, there is no shortage of individual securities to choose from. Examples include Barrick Gold Corp. (NYSE: GOLD) and Pan American Silver (Nasdaq: PAAS), two companies heavily involved in mining.

- Derivatives: Want to invest in gold without actually investing in gold? Gold and silver futures give you plenty of opportunities to make money off of changes in commodity prices. There’s more risk associated with derivatives, but there’s also more reward.

The above options are in order of riskiness – least to most. ETFs offer better exposure to many different gold and silver companies, thus mitigating risk. Meanwhile, derivatives can be tricky to navigate in a commodities market where price is always in flux. Some options like bullion are safe but cumbersome. The best mode of investment really varies by person.

Should You Invest in Gold? Silver? Both?

The fact is, gold and silver are generally a good investment at any time. It’s the reason for investing in them that changes.

Traditionally, precious metals have been a hedge against stock market instability. The idea is that investing in gold and silver will protect you from market downturns. As stocks plunge, physical assets rise. This is still largely true. In bear markets, gold and silver are solid performers.

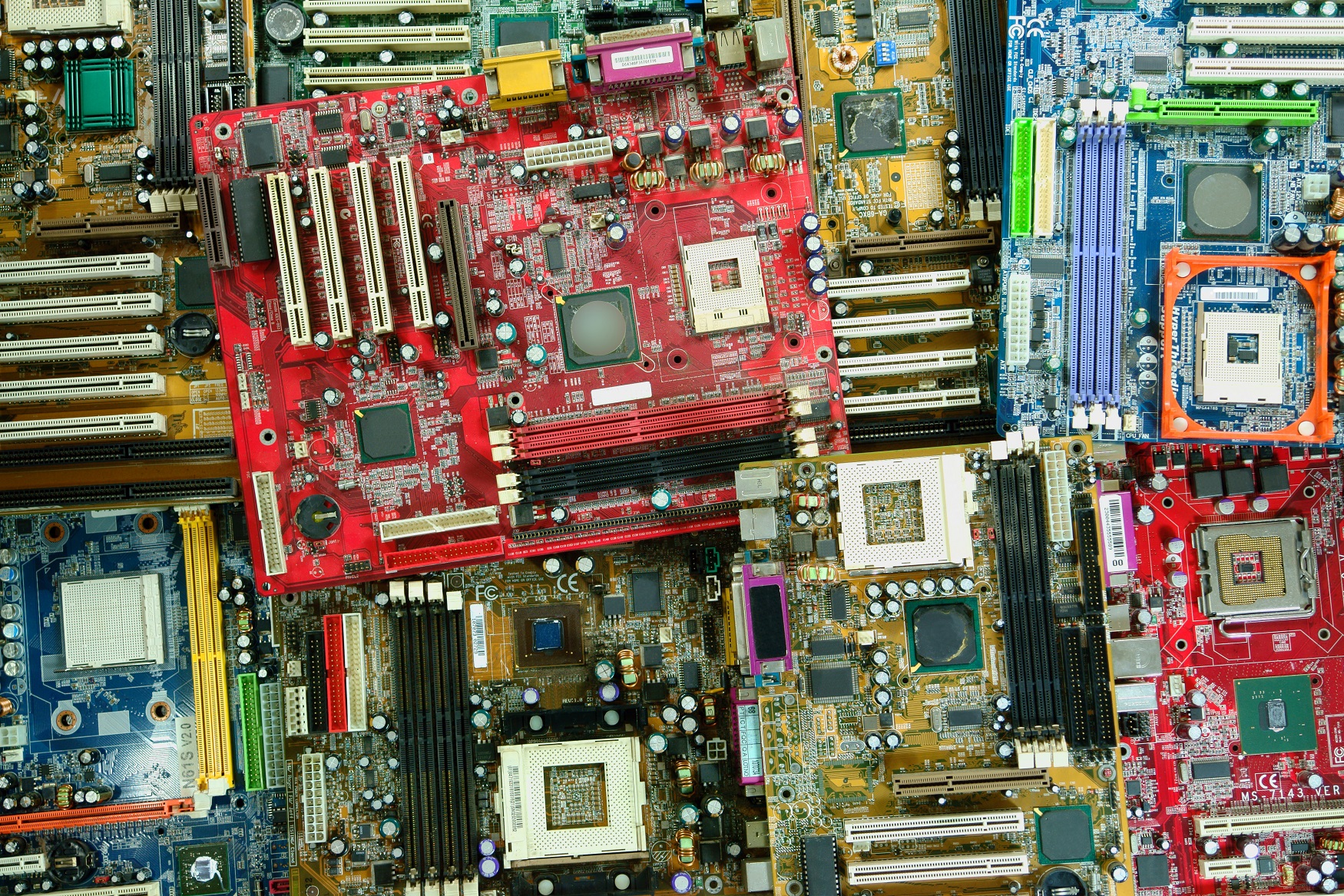

But what about bull markets? While it’s true that gold and silver tend to stay depressed in strong markets, there are other reasons to invest in precious metals. For one, they’re practical. Electronics manufacturing uses both gold and silver, and both are in high demand. And, because there’s a finite supply of these materials, buying to match demand turns them into a lucrative investment opportunity in their own right.

The bottom line is that it’s never a bad idea to have some exposure to precious metals. Gold and silver belong in every person’s portfolio. The amount of your allocation will depend on how the current market performs and the appeal precious metals have for you.

The Pros of Precious Metal Investing

It’s hard to put a price on inflationary protection, and that’s exactly what gold and silver offer. They’re immune to the market forces that cause instability in securities. As a result, they tend to be a relatively low-risk investment. Moreover, gold and silver aren’t going out of style anytime soon – they’ve been symbols of wealth since the beginning of civilization.

The other big upside to precious metals investing is that there are so many different opportunities. If you prefer a tangible investment, it’s easy to find and purchase something like Krugerrands or ingots. Or, if you prefer convenience, there are securities and ETFs that offer great exposure.

Beware the Drawbacks of Precious Metals

The drawbacks of precious metals are that they’re often subject to price swings due to changing spot prices, governed by demand. While investing in companies mitigates this a little, there’s still the volatility that comes with availability. Remember, these are rare and precious metals!

Perhaps the biggest drawback comes in the physical form of the assets. If you choose to hoard physical gold or silver bullion, you’ll need a safe place to store it. Moreover, it can be cumbersome to manage physical inventory. And your holdings are relatively illiquid until you sell them to a gold or silver dealer. Even then, what you’ll get depends on the spot price.

Gold and Silver Can Diversify Your Holdings

Investing in gold and silver traditionally serves the role of hedging against stock market instability. Gold, silver and other precious metals are inherently valuable. When the stock market is on a rollercoaster, defensive investors benefit from the stability of commodities. But these days, precious metals aren’t just a defensive play. The global demand for gold and silver have made these investments highly lucrative outside of a hedge. It all depends on how you invest in them.

For the latest investment trends, sign up for the Profit Trends e-letter below. Commodities are hot right now, and the experts at Profit Trends will break it all down for you.

If you’re enticed by the stability of gold and silver, stick to ETFs. If you like a little more risk, futures and options are ways to double down on your love of precious metals. Or, if you want a pure-play investment option, there’s always bullion to buy and sell. In any case, you’ll have access to gold and silver – and the long-term benefits that come with investing in them.

18 Comments

[…] Users of this service also have access to gold and silver for those who like to dabble in trading precious metals as well. iTrustCapital also offers 24/7 crypto support and secured […]

[…] safeguard capitalists against changes in the gold cost through the purchase of physical gold. When read this article holding gold financial investments problem stock, the holders of such stock are safeguarded with a […]

[…] your gold financial investment. Among these is to invest in a gold individual retirement account. Gold Silver IRAs is a specialized sort of IRA that permits you to invest in gold as an asset. These types of IRAs […]

[…] as the vendor. A gold bar is a single unit that is determined in kiloogold, gold or troy ounces. is lear capitals gold-silver ira a good investment are typically shipped with carrier or road products. You must acquire gold bars from a trusted […]

[…] gold bar each time from these companies, or you may determine to buy a gold financial savings plan. what is a gold or silver ira resembles a mutual fund except that instead of getting fixed rate of interest payments, you obtain […]

[…] inUncategorized https://dev2.investmentu.com/investing-in-gold-and-silver/ by-Borup ThorsenOf all the rare-earth elements offered, gold is certainly one of the most prominent […]

[…] remain to expand in appeal as a result of the ease of tracking the performance of digital assets. visit the next site of gold financial investment include physical gold mutual funds. Physical gold can be bought from a […]

[…] all the rare-earth elements offered, gold is undoubtedly the most commonly traded as a property. how to own gold in your ira buy gold as a way of diversity, specifically with the use of derivatives as well as exchange-traded […]

[…] costs on the asset. Several of these items are called a top gold financial investment. In https://dev2.investmentu.com/investing-in-gold-and-silver/ , we’ll review a few of the leading gold investment options available.When you begin […]

[…] stocks as well as shares is a safe alternative, you must think about the dangers of gold. Since https://dev2.investmentu.com/investing-in-gold-and-silver/ does not give cash flows until sold, it is a wonderful hedge in a time of financial crisis. This […]

[…] earn a dividend by owning gold this way. Most folks are stuck in what I call the “old world” of gold investing. They buy a chunk of gold and hold on to it, expecting it to someday soar in value. They never sell […]

[…] earn a dividend by owning gold this way. Most folks are stuck in what I call the “old world” of gold investing. They buy a chunk of gold and hold on to it, expecting it to someday soar in value. They never sell […]

[…] earn a dividend by owning gold this way. Most folks are stuck in what I call the “old world” of gold investing. They buy a chunk of gold and hold on to it, expecting it to someday soar in value. They never sell […]

[…] by owning gold this way. Most folks are stuck in what I call the “old world” of gold investing. They buy a chunk of gold and hold on to it, expecting it to someday soar in value. They never sell […]

[…] by owning gold this way. Most folks are stuck in what I call the “old world” of gold investing. They buy a chunk of gold and hold on to it, expecting it to someday soar in value. They never sell […]

[…] earn a dividend by owning gold this way. Most folks are stuck in what I call the “old world” of gold investing. They buy a chunk of gold and hold on to it, expecting it to someday soar in value. They never sell […]

[…] enough, since the beginning of 2022, both gold and silver have spiked in value (largely because of the Ukraine conflict). Moreover, U.S. Treasuries are […]

[…] enough, since the beginning of 2022, both gold and silver have spiked in value (largely because of the Ukraine conflict). Moreover, U.S. Treasuries are […]