Profiting Off Volatility With ProShares UltraShort Dow30 ETF

It was certainly a day for the ages yesterday – as the Dow had one of the single worst days in history sparked by renewed coronavirus fears.

There must be something about the month of February. Here’s an important historical note that we all should consider…

Back in February of 2018, the Dow dropped more than 1,175 points on Monday – only to drop another 1,000 the following Thursday.

I bring this up because we could very well have a repeat downside performance as the week goes on. That precedent was set two years ago – and feels like it applies again today.

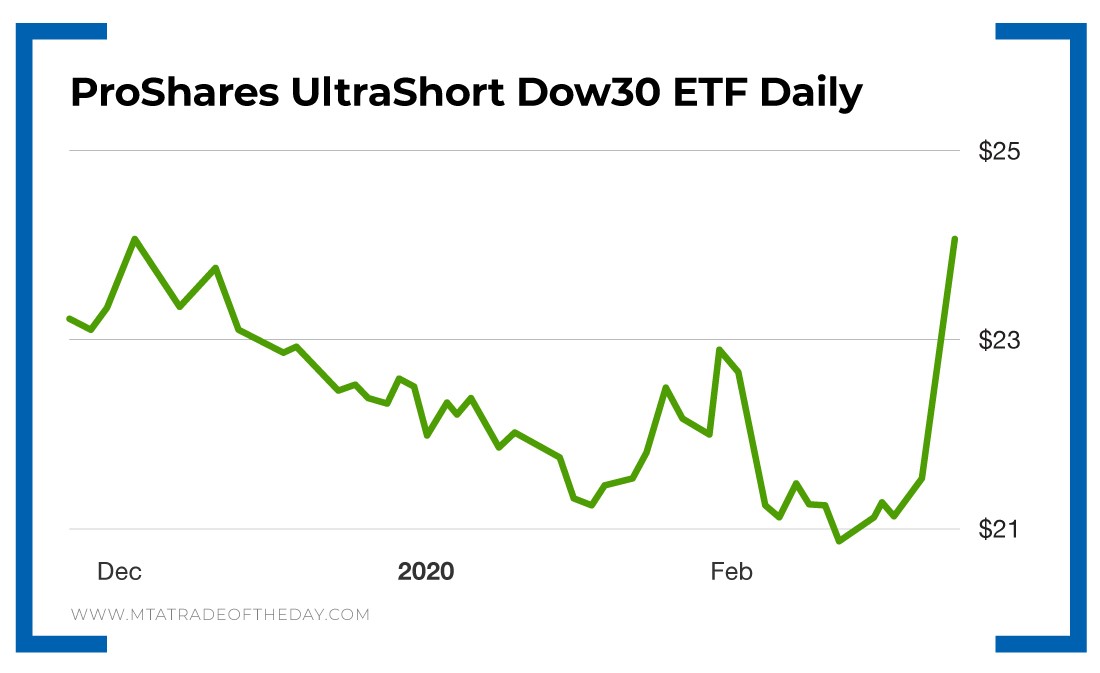

That’s why I recommended War Room members trade in and out of the ProShares UltraShort Dow30 ETF (NYSE: DXD) multiple times today.

I hinted at this in yesterday’s Trade of the Day, but I’ll expand on it a little more today…

The ProShares UltraShort Dow30 ETF moves at a rate of two times the inverse (negative 2X) of the daily performance of the Dow Jones Industrial Average.

Simply put, if the Dow moves down 3% on the day (like it did yesterday), the ProShares UltraShort Dow30 ETF moves up 6%.

So it’s a wonderful way to protect yourself against market selling pressure.

Why do I prefer the ProShares UltraShort Dow30 ETF?

Well for one, it’s cheap.

And the larger blue chip companies tend to have more global exposure, which makes them more susceptible to ongoing coronavirus fears.

United Airlines and Mastercard have already warned about upcoming losses due to the spreading virus. It’s reasonable to think that other major companies will be lining up with warnings as well.

After yesterday’s massive drop, the entire world is looking at standard price-to-earnings (P/E) ratios – and yet nobody has a clue about what the “E” will be.

With such a tremendous question mark for the future earnings of every global company, the market has currently found itself in a state of flux.

Action Plan: I find this to be such an important point – because the market hates uncertainty. And right now, nobody knows exactly how the coronavirus will impact their future earnings.

So as traders, we once again take on the “read and react” approach to the markets. We see the action – we track the sentiment – we position ourselves accordingly.

Members are holding the ProShares UltraShort Dow30 ETF for protection. In this market, playing both sides like this is critical for daily trading success, so join me in The War Room and let your trading journey begin!