Profit From the Next Market Drop

For the first three weeks of 2020, all was well in the market. The S&P 500 rose from 3,230 on December 31 to 3,320 on January 21 – a rise of nearly 3%.

And then novel coronavirus became a thing. The market slid, and volatility spiked.

Volatility measures how much and how fast stock or market prices move.

If a stock (or the market) moves an average of 1% per day and tomorrow it drops 3%, you could say volatility increased. If it climbs 0.5%, you could claim volatility is low.

When market commentators talk about volatility, it is usually talked about in a negative light. “The market is volatile” usually means the market is falling or it’s unpredictable.

When markets steadily climb, like they did for most of 2019 and the first few weeks of this year, volatility is usually quite low.

It’s when there are sudden price shocks that volatility spikes…

And that’s exactly what happened in the market after the coronavirus became a global concern.

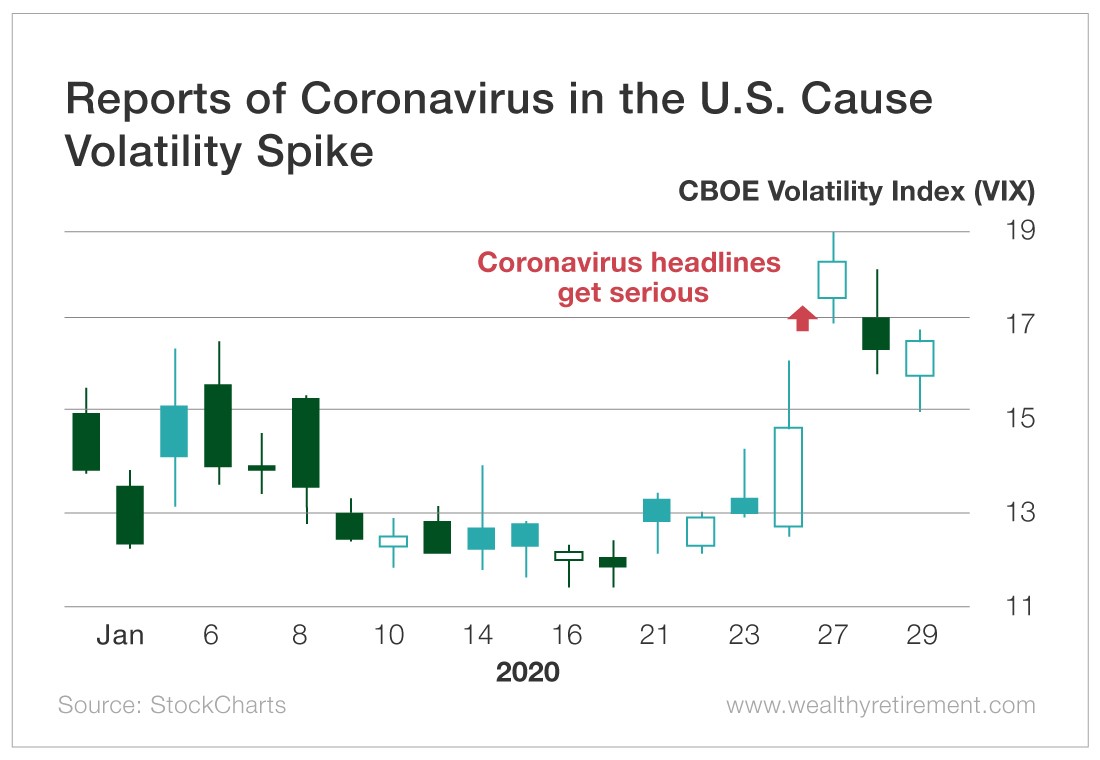

Stock market volatility is represented by the CBOE Market Volatility Index, also known as the VIX. When you look at a chart of the VIX, you can get a quick understanding of whether volatility is increasing.

You can see on this chart of the VIX that volatility spiked when fears about the coronavirus grew after a second case was discovered in the United States on Sunday, January 26.

When the market opened on Monday, volatility shot higher.

This is because panicked investors sold assets quickly. The speed of the decline was an important factor in rising volatility.

But you don’t have to suffer that panic each time headlines cause a volatility spike…

How to Safeguard Your Portfolio When Volatility Spikes

There are ways to protect your portfolio against volatility.

The easiest thing to do is to buy put options, which provide insurance against a particular stock or the market going down.

The key is to buy the puts when the market is rising and volatility is low because volatility is a key component of options pricing.

So when volatility is low, the price of the puts will be low as well.

It makes sense when you think about it. If you bought homeowners insurance as a hurricane was barreling toward your house, the insurance company would charge you a lot more than if you bought the policy when things were quiet.

In the same way, if markets are tanking and volatility is rising, it will cost more to insure your stock or portfolio with the put option.

What’s great about this strategy is that when you sell the put in a market decline and volatility spikes, you win two ways…

First, the value of the put rises as the stock or market falls.

Second, the volatility component of the option’s price will increase as well. You’re essentially selling that insurance contract in the middle of the hurricane.

You can also trade options on the VIX itself, or you can buy exchange-traded funds or other vehicles that are based on volatility if you want a pure-play trade.

The next time a market commentator or one of your friends claims the market is “volatile,” consider whether it really is and why it’s important – or if they’re just substituting the word “volatile” for a falling market.

Good investing,

Marc