“Events, My Dear Boy, Events!”

One of my favorite quotes was uttered by Harold Macmillan, Britain’s prime minister in the late 1950s and early 1960s.

Soon after he ascended to power, Macmillan was asked by a journalist what was most likely to determine the success of his new government.

“Events, my dear boy, events,” was his reply.

And this is an idea I try to keep in mind as I build my portfolio and implement my financial plan for the future. Because as much as we try to predict what’s going to happen, as much as we labor to accurately forecast the course of the economy and the success of this sector or that stock, events invariably overtake us.

Just last week, we had the completely unexpected implosion of a massive Chinese real estate developer called Evergrande Group. It took markets by surprise – to put it mildly – and sent stock prices plummeting.

It also sent the CBOE Volatility Index, or the VIX, soaring. The VIX (which I like to think of as the market’s blood pressure reading) had been quiet for weeks, settling at a low level of around 16. As the Evergrande disaster built and investors got wind of it, the VIX spiked to near 26 on September 20.

The market absorbed the Evergrande news and moved on by the end of last week. But this week, new events are upon us.

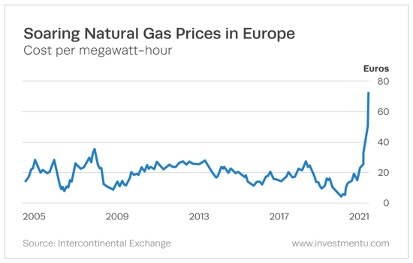

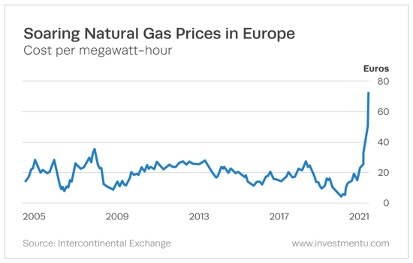

Suddenly, we’ve got an energy crisis in Europe. It’s becoming clear that there is a shortage of natural gas, and nations are starting to bid against each other for energy resources, sending prices of both oil and natural gas skyward.

Here’s what the price of natural gas in Europe is doing now…

Soaring Natural Gas Prices

The scary part of all this is that this shortage is expected to worsen as temperatures drop this fall and consumers and businesses use more natural gas.

The natural gas shortage is also spilling over into crude oil prices. The price of Brent crude oil – which is the benchmark for international oil prices and was priced near $65 in mid-August – is now more than $79 per barrel, and it’s expected to rise to $80 per barrel by year-end. For energy investors, this is a good thing. Energy stocks, like Exxon Mobil (NYSE: XOM) and Chevron (NYSE: CVX), were up sharply on Monday.

Early Fed Exit

In addition, there’s been an unexpected development this week at the Federal Reserve – which, as you know, the markets watch obsessively.

Eric Rosengren, president of the Boston Fed, announced an early retirement due to health reasons. He may have also been pressured to retire because it was revealed he was trading securities while serving as a top Fed official.

Either way, it came as a shock to the markets as the trading week started, raising very important questions about how Rosengren’s abrupt departure will influence monetary policy.

As a result of these two unexpected events, market volatility rose on Monday morning. The VIX was back up 3.4% to around 18.35.

All this made me think of my old friend Bryan Bottarelli, co-founder of The War Room and Technical Options Expert of Monument Traders Alliance, because he absolutely loves volatility. So I checked in with Bryan on Monday afternoon about what’s going on in markets.

“The more volatile the markets – the better we trade,” he told me enthusiastically. “During the COVID-19 meltdown, we traded with an accuracy rate above 90%.”

And last week, amid the Evergrande crisis, Bryan’s recommendation on a Chinese exchange-traded fund gave War Room members an overnight win of 60%.

As for spiking energy prices, Bryan tells me he’s positioned on an energy trade that “will easily double” if the current crude oil price trend continues.

And that, it seems to me, is how you profit from events – unexpected ones in particular. Events can often have the biggest impact on your success in markets and elsewhere. It’s a good thing to remember.

If you’re curious about The War Room but not quite ready to pull the trigger on joining this merry band of readers, then I’ve got good news for you.

Next week, the War Room team will have an “open house” where you can see all their research and get all their live trade recommendations. And you’ll be able to experience firsthand the enjoyment and excitement War Room members share as they make winning trades together.

The War Room Open House lasts from October 4 to October 8. To secure your spot for this free event, you need only RSVP here .

Be sure to check your email tomorrow for more up-to-the-minute insights from Investment U’s top market experts.

Invest wisely with Investment U,

Matt