This ETF Gets You Defense, Aerospace and Cybersecurity All Wrapped Into One

This past week, Barron’s said, “Cybersecurity companies are among the safer stocks as China and the U.S. lock horns over trade” and that one way to sidestep the trade war is to focus on cybersecurity companies like Palo Alto Networks and CyberArk.

It seems like a reasonable strategy…

After all, according to research firm Gartner, global spending on the broader cybersecurity market exceeded $114 billion in 2018, which represented a 12.4% increase from 2017.

By the end of this year, the global cybersecurity market is expected to expand to $124 billion – another 8.7% increase.

And by 2022, the global cybersecurity market is projected to reach $170.4 billion, good for a staggering 37% increase.

But choosing a cybersecurity stock isn’t as easy as it seems.

For instance, CyberArk is up 67% year to date. That’s fantastic.

But Palo Alto Networks is up only 2.7% year to date. That’s atrocious.

To best capitalize on the cybersecurity spending spree, how do you choose between these two?

My vote: Buy neither of them.

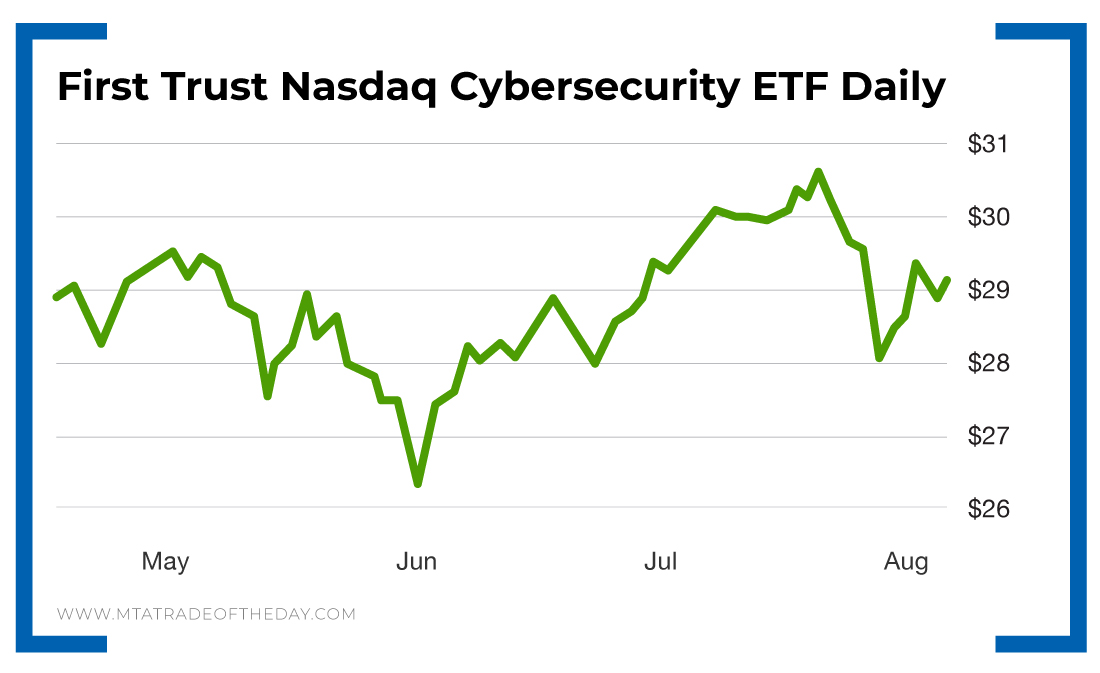

Instead, play the First Trust Nasdaq Cybersecurity ETF (Nasdaq: CIBR).

Year to date, the First Trust Nasdaq Cybersecurity ETF is up 24.7%. Sure, that’s not as strong as CyberArk, but it’s far more appealing than Palo Alto Networks.

With this ETF, you get a wide variety of security-related companies, including Splunk, Okta, Palo Alto Networks, Symantec, Cisco, Akamai Technologies and even Raytheon.

In a way, the First Trust Nasdaq Cybersecurity ETF is a play that gives you exposure to defense, aerospace and cybersecurity – all wrapped up into one.

Action Plan: If you’ve been reading our Trade of the Day issues – then you’ve certainly seen notes and testimonials from War Room users about how much money they’ve been making on a daily basis.

If you’ve been considering joining us in The War Room, then click this link for more information!