Kodak Jumped 2,000%… This Stock Just Sent the Same Signal!

This company looks ripe for takeoff. It’s not going to jump 2,000%, but War Room members are aboard for a ride.

EHealth (Nasdaq: EHTH) is a company that wants to revolutionize healthcare. It provides a private online source of health insurance for individuals, families and small businesses.

It’s the parent company of eHealthInsurance, a private health insurance exchange, where individuals, families, and small-businesses can compare health insurance products from various insurers side by side and purchase and enroll in coverage online through any of its five websites or via phone through its customer care centers. The company also offers various online and pharmacy-based tools to help seniors navigate Medicare health insurance options, choose the right plan and enroll in plans.

It markets the availability of individual, family, small business and ancillary health insurance plans of various insurance carriers through its e-commerce platforms.

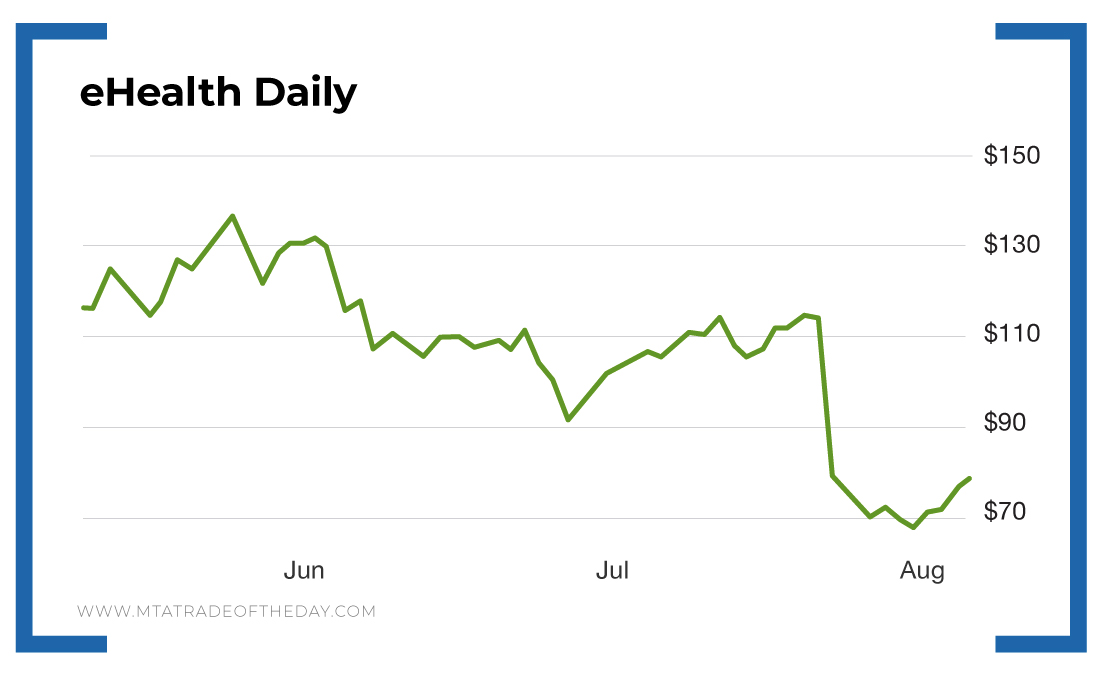

EHealth reported earnings a few days ago. And while it beat earnings, the Street didn’t like the commentary from the conference call regardless of how optimistic and bullish CEO Scott Flanders was. So the stock sold off.

The stock fell from $112 to just under $70. Then last week, an insider bought a couple thousand shares at less than $70 for about $140,000. As soon as I saw that, I started to do my research.

On Wednesday, War Room members got the signal to jump in. Then after the market closed, Flanders put his money where his mouth is and laid down a cool $3.5 million to buy shares on the open market.

When you see two big insider purchases like this, you are close to seeing the strongest signal in the market – cluster buying.

That same signal allowed me to tell members that something was happening at Kodak in March. Shares were around $2 at that time.

Last week, they jumped to $50 on news that the company was chosen by the government to produce drug ingredients in the U.S. The shares have corrected since, but they are still trading at more than seven times the price that insiders paid.