COVID-19 Just Saved This Heavily Shorted Stock

This might sound really, really strange…

But there’s one company out there right now that might’ve just been “saved” by the coronavirus.

No, the company doesn’t make ventilators.

And no, it hasn’t discovered a vaccine.

But Bloomberg calls it “the next best thing in the COVID-19 pandemic.”

What am I taking about?

The company is Blue Apron (NYSE: APRN) – and its amazing story of “rebirth” is the basis behind today’s Trade of the Day.

So let’s wash our hands and dive in…

Quite simply, Blue Apron operates a direct-to-consumer platform that delivers original recipes and fresh and seasonal ingredients straight to your doorstep.

The company essentially sends you a box full of every meal ingredient you need. You unpack it all, get the included recipe card and then make the entire meal in your own kitchen.

A wine delivery and pairing service is also offered to accompany these meals – just to top off the experience.

Now, even though Blue Apron is based in New York, the coronavirus lockdown has given the company a second chance at life.

You see, in a recent Securities and Exchange Commission filing, Blue Apron CEO Linda Findley Kozlowski admitted that the company was considering its options in light of potential dissolution.

And no wonder. The stock went public in 2017 – and has been trading lower ever since. Its 52-week high was above $28, and its 52-week low was around $2.01. Growth had stagnated. Operating margins were down 11.45%.

In short, Blue Apron Holdings was toast.

But then, the coronavirus hit.

And you know what happened next…

People were staying home.

Bars and restaurants started closing.

And in response, everyone wanted their meals delivered.

That’s when Kozlowski noted “a sharp increase in consumer demand.”

From a stock perspective, this sparked a crazy upside move.

You see, a lot of investors thought that Blue Apron was going bankrupt. And therefore they shorted the stock. As it stands today, 48% of the stock’s float is currently sold short.

That’s where things get interesting…

You see, when a heavily shorted stock starts to receive unexpected buying interest, the shorts get spooked and they cover their position. This creates a “short squeeze” situation – which is one of the most powerful upside trigger catalysts you’ll see on Wall Street.

Case in point…

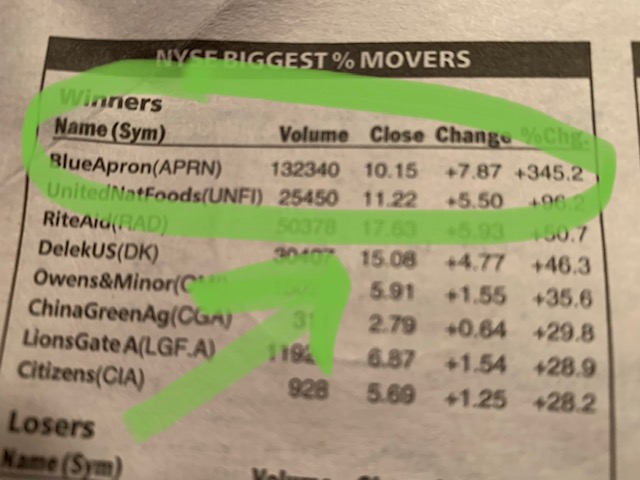

In one week, shares of Blue Apron moved up 345%.

In early March, it was the biggest weekly gainer on the entire New York Stock Exchange!

That’s right! Once troubled and left for dead, Blue Apron shares have jumped more than fourfold from their March 13 low.

And Blue Apron isn’t the only meal delivery service that’s on fire. Over in Europe, Berlin-based HelloFresh stock is up 70% this year. So this appears to be a global trend that’ll only get stronger in the weeks and months ahead.

Action Plan: Once a floundering home-cooking meal delivery service, Blue Apron is now getting a surprise lifeline thanks to the COVID-19 quarantine. The company just announced that it’s “staffing up” to meet a higher demand as cities and states require residents to stay in.

What better way to get your meals than delivered to your doorstep? As amazing as it sounds, there could be more room for this stock to go. After all, there is a major short squeeze in play right now, so this upside push could have legs.

If you’d like to play Blue Apron and other trades LIVE, as they happen in real time, you’re invited to join me in The War Room!