Cheap Stocks to Watch As the Market Crashes

There are plenty of cheap stocks to watch and buy if you know where to look. Many companies are trading at bargain prices right now. And savvy investors can take advantage of the situation. They can do this by scooping up shares while they’re still relatively low.

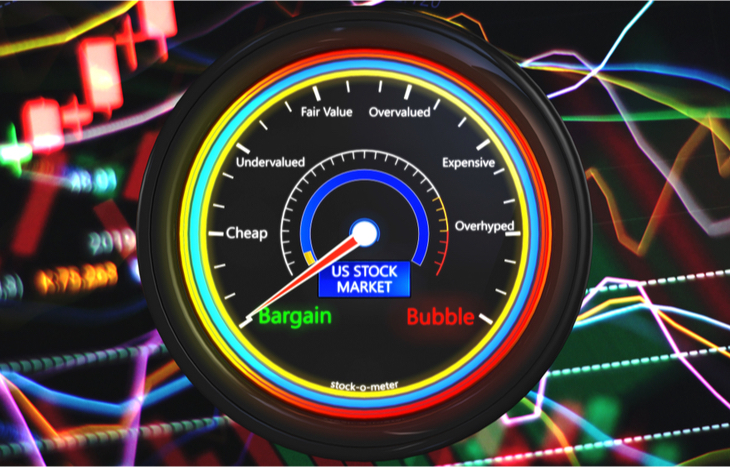

Is the Stock Market Going to Crash?

Well, there are many different factors that go into such a complicated prediction. Why do cheap stocks hold up well during market downfalls? There are a few reasons.

Investors and analysts often overlook cheap stocks. This means they may not be as well-researched or well-followed as other companies. Which can make them more resilient to negative news and events.

And cheap stocks tend to be undervalued by the market. This means there’s more upside potential for these stocks. Especially when the market eventually rebounds. Plus, cheap stocks are often overlooked by most investors. This means that there’s less selling pressure on these stocks when the market is crashing.

So, if you’re looking for cheap stocks to buy during a market crash, keep an eye out for these characteristics. With a little patience and research, you should be able to find some great bargains that will pay off overall.

Of course, not all cheap stocks are created equal. Just because a stock is cheap doesn’t mean it’s a sound investment. You still need to do your homework. And make sure you’re investing in a solid company with a sound financial outlook.

But if you’re willing to put in the work, there are some real bargains to be had out there. Keep reading to check out a list of cheap stocks to watch right now.

Cheap Stocks to Watch

No. 4 Servicesource International, Inc. (Nasdaq: SREV)

Servicesource International, Inc. is a provider of technology-enabled services and solutions. These enable companies to improve their customer and revenue growth. The company offers a suite of solutions that helps companies engage customers. Plus, optimize performance, and maximize revenue growth. And they founded in 1999 and are headquartered in San Francisco, California.

The company’s technology-enabled services and solutions are delivered through its global network. And this network consists of over 4,000 service professionals in more than thirty countries. Servicesource has a proven history of helping companies. In particular, improving their customer and revenue growth.

In the current market conditions, cheap stocks are worth a look. Especially as they may offer investors an opportunity to buy into a company at a lower price than usual. Servicesource International, Inc. is one cheap stock that investors may want to consider. The company’s tech-enabled services and solutions could help businesses out. And Servicesource helps them weather the storm and come out stronger on the other side. As such, it is a great cheap stock to watch during the market crash.

No. 3 Acer Therapeutics Inc. (Nasdaq: ACER)

Acer Therapeutics Inc. is a pharmaceutical company focused on the development and commercialization of therapies. Specifically for serious rare and life-threatening diseases. The company’s lead product candidate is a medicine. This medicine helps with babies born with stunted ability to metabolize.

So, this is a great cheap stock to watch as the market crashes. The company’s share price has already dropped significantly in 2019. Which makes it an attractive investment for bargain hunters. Also, Acer has a strong pipeline of products in development. Which gives it potential upside even if the market continues to decline.

Investors should keep an eye on Acer Therapeutics as the market crash continues. The company’s share price is attractive at current levels. And it has significant upside potential if its pipeline of products proves successful.

Keep Reading This Article and Find Out the Top 2 Cheap Stocks to Buy Now

Enter your email below to read the reveal the top two cheap stocks.

You’ll also be opted in to receive our free daily e-letter, Investment U, where you’ll find expert investment insight, analysis and stock picks for all the best investment opportunities.

Nunc ut lorem quis urna auctor ornare quis in sem. Donec sodales viverra ante, et scelerisque libero iaculis sit amet. Phasellus fermentum vitae tellus quis suscipit. Ut bibendum aliquet odio, a venenatis augue fermentum at. Nunc fringilla dui lorem, congue blandit ex egestas in. Vestibulum dapibus orci ut felis consequat euismod. Sed pretium, risus vel blandit porttitor, diam diam sodales dui, in lobortis lorem ex vitae est. Nullam ac venenatis massa. Integer blandit, diam et fringilla semper, nulla dui suscipit urna, eget hendrerit quam ex rutrum tellus. Nam imperdiet, nibh nec mollis vulputate, felis ante posuere leo, at ultrices nulla neque vitae mi.Nunc ut lorem quis urna auctor ornare quis in sem. Donec sodales viverra ante, et scelerisque libero iaculis sit amet. Phasellus fermentum vitae tellus quis suscipit. Ut bibendum aliquet odio, a venenatis augue fermentum at. Nunc fringilla dui lorem, congue blandit ex egestas in. Vestibulum dapibus orci ut felis consequat euismod. Sed pretium, risus vel blandit porttitor, diam diam sodales dui, in lobortis lorem ex vitae est. Nullam ac venenatis massa. Integer blandit, diam et fringilla semper, nulla dui suscipit urna, eget hendrerit quam ex rutrum tellus. Nam imperdiet, nibh nec mollis vulputate, felis ante posuere leo, at ultrices nulla neque vitae mi.

Integer blandit, diam et fringilla semper, nulla dui suscipit urna, eget hendrerit quam ex rutrum tellus. Nam imperdiet, nibh nec mollis vulputate, felis ante posuere leo, at ultrices nulla neque vitae mi.Nunc ut lorem quis urna auctor ornare quis in sem. Donec sodales viverra ante, et scelerisque libero iaculis sit amet. Phasellus fermentum vitae tellus quis suscipit. Ut bibendum aliquet odio, a venenatis augue fermentum at. Nunc fringilla dui lorem, congue blandit ex egestas in. Vestibulum dapibus orci ut felis consequat euismod. Sed pretium, risus vel blandit porttitor, diam diam sodales dui, in lobortis lorem ex vitae est. Nullam ac venenatis massa. Integer blandit, diam et fringilla semper, nulla dui suscipit urna, eget hendrerit quam ex rutrum tellus. Nam imperdiet, nibh nec mollis vulputate, felis ante posuere leo, at ultrices nulla neque vitae mi.

Final Thoughts on Cheap Stocks

The market crash has been a tough time for many investors. But, there are still some cheap stocks to watch. The ones listed above have potential, even in a down market.

However, investors should not expect immediate gains from these companies. The market is still volatile and cheap stocks could become even cheaper. So, investors should keep an eye on these stocks and wait for the right time to buy. So, while the market crash has been tough on many investors, there are still some cheap stocks to watch.