With this bond yield calculator you can find both the current yield and yield to maturity (YTM). This tool can help you with setting up a better income portfolio.

Enter bond numbers below and you’ll instantly see the results. By playing around with these numbers, you can get a better idea of how bonds work and test the yield to maturity of different bonds. For example, bond prices and yields move in opposite directions.

Below the calculator, you’ll find definitions for each variable. I’ve also included the formula behind this yield to maturity calculator.

Bond Yield Calculator

The Current Price is the recent market price of the bond. This is how much investors are willing to pay for the bond today. There are many factors such as interest rates, inflation and credit ratings that help determine the price of a bond.

The Par Value is the initial value of the bond at the time it was issued. This value is usually $1,000. It’s also often called the Face Value of a bond.

The Coupon Rate is used to determine the coupon payments to bondholders. It’s usually a fixed percentage that’s based on the par value of the bond. This is listed on an annual basis and most bonds pay semi-annual coupons. For example, a 5% coupon rate on a $1,000 par value bond will pay out $50 each year (two $25 payments).

The Years to Maturity is how long the bond will be around before it expires. At the bonds maturity, it pays bondholders the final coupon and returns the par value. Continuing with the example above, the investor would receive $1,025 at maturity.

Current Yield and YTM Formulas

This bond yield calculator has two formulas behind it. And once you get a good grasp of these concepts, you’ll have a better understanding of investing in general. These ideas and formulas overlap with many areas of the financial world.

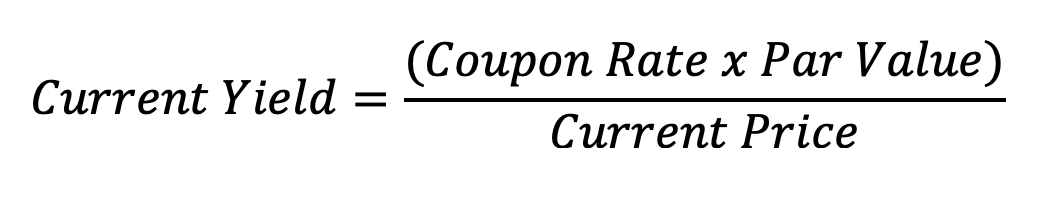

To start, let’s look at the current yield formula…

This shows you how much income you can expect each year (non-maturity year) via coupon payments relative to the current price of the bond.

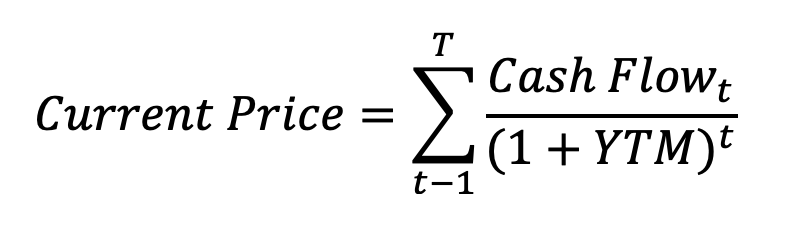

If you plan to buy and hold the bond to maturity, this next formula is a little better at finding the total annual return…

Many calculators and spreadsheets have a built in YTM function. And this is the formula behind it. It’s discounting and summing up each of the cashflows over the life of the bond. These are usually the semi-annual coupon payments and the final maturity payment.

To really understand this formula behind the bond yield calculator, it’s important to realize the time value of money. In other words, a dollar today isn’t worth the same as a dollar a year from today. That’s thanks to inflation and a wide range of other factors. Investors generally want their investment returns to outpace inflation.

So, with this bond yield formula, t is used to factor in different times for the cashflows. The further away the cashflow, the lower the present value.

I remember seeing this concept for the first time and it took me awhile to get a grasp of it. What really helped was seeing a clear example…

Bond Yield Calculator YTM Example

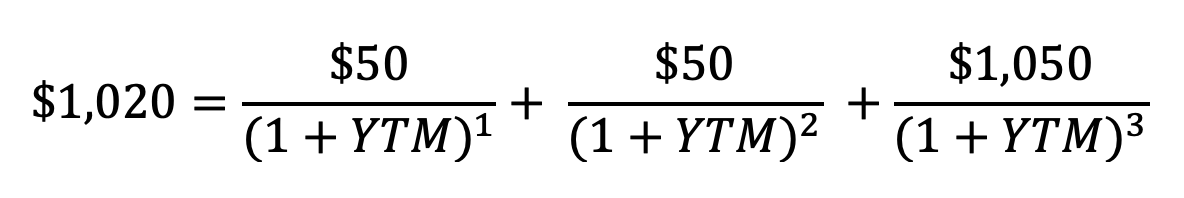

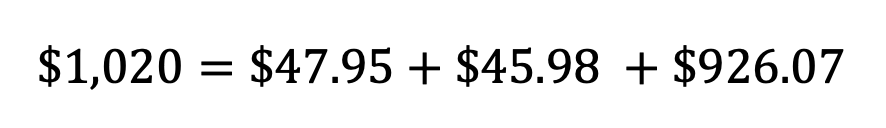

Let’s use a bond that’s maturing in exactly three years. It currently trades at $1,020 – just above par value. It has a coupon rate of 5% and for simplicity, let’s say it pays an annual coupon instead of semi-annual (if you’re calculating for semi-annual bonds, there are a few extra steps).

Here’s the formula from above with these numbers plugged in…

You can test out different YTMs that will make the right side equal the left side. I’ve done that work for you and the YTM is close to 4.28%.

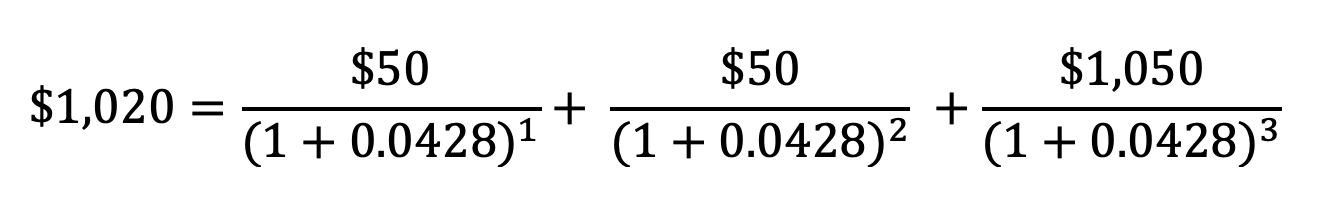

This will give us the present values for each cashflow…

This equation then simplifies down to…

Playing around with the numbers and getting hands on experiences is the best way to learn. You can use the bond yield calculator to test out different investment examples. You can compare your calculations and see if they match up. It’s also possible to test bonds you currently hold to see if your YTM will outpace inflation.

Bond and Income Investing

With this knowledge, you should be better prepared to set up an income portfolio. You will also be more ready to explore bond investing and the many other investment opportunities out there.

For example, dividend stocks can be another great source of passive income. And reinvesting both your dividends and interest can compound your returns even more. To see how this works, check out this free investment calculator. It gives a great visual on how your portfolio can grow.

And if you want more investing research and insight, check out our best investment newsletters page. These newsletters are packed with helpful investing information and research for new and experienced investors.