Will Axiom Space IPO? Why Investors Want Axiom Stock

Will investors see Axiom Space stock? Unfortunately, there are no plans for an Axiom IPO right now. But some analysts think the company might go public in the next couple years.

So, will Axiom go public? Here’s what we know…

Axiom Space IPO: The Business

President, CEO and former NASA program manager Michael Suffredini co-founded Axiom Space with Executive Chairman Kam Ghaffarian in 2016. Headquartered in Houston, Texas, Axiom is an American aerospace manufacturer and orbital spaceflight services company. Like SpaceX and Blue Origins, Axiom aims to democratize space, making it accessible to everyone in the future.

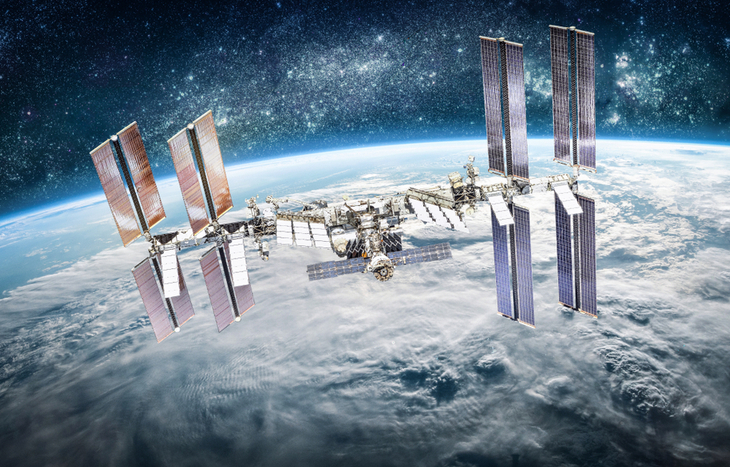

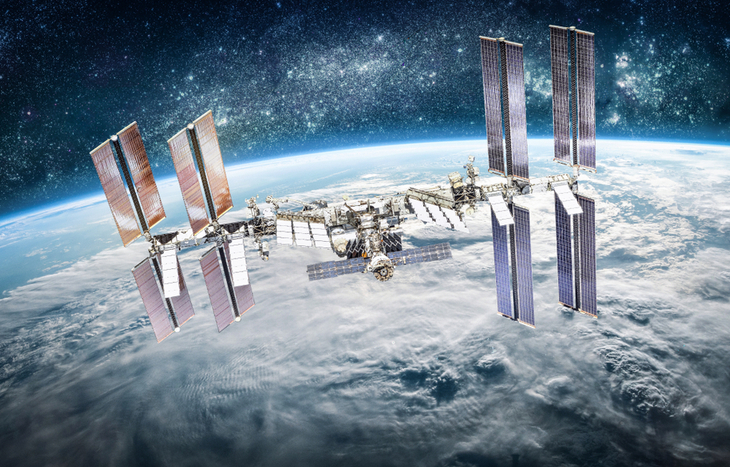

Axiom’s big project is a commercial space station. The International Space Station (ISS) is set to retire in 2028, 30 years after it was launched. Axiom is working to build its own segment that will detach from ISS when NASA retires it. Until then, Axiom offers access to the ISS with full-service crewed missions for professional and private astronauts.

According to Axiom, both Bank of America and Morgan Stanley estimate the space economy will be worth more than $1 trillion in the next couple decades. And as the space race heats up, investors are looking for opportunities everywhere. Could an Axiom Space IPO be one of those opportunities?

Reasons for Axiom Space Stock

There are a few reason investors are looking for Axiom stock. To start, the company is tackling a part of the space niche no one else is: the destination. While SpaceX, Virgin Galactic and others are focused on spacecraft and space tourism, Axiom is looking to go beyond that. Its commercial space station will be used by companies across multiple industries for research, services and more.

To accomplish this, Axiom recently closed its Series B funding round. In June, C5 Capital asked Axiom if it could lead the round. Other investors included Declaration Partners, Hemisphere Ventures, The Venture Collective and Moelis Dynasty Investments, just to name a few. The company raised $130 million. This brings total funding raised since founding to $150 million. Suffredini said the funds will be used to make a major payment in building its station module and to expand its team.

Although Axiom management hasn’t revealed the company’s valuation, Suffredini did say it’s well past the point of becoming a unicorn. That means its valuation is greater than $1 billion.

But Axiom made another announcement with its Series B funding.

Blue Origins Veteran Joins Board

One reason investors think Axiom stock could be coming soon is the company announced Rob Meyerson is joining the board of directors. Meyers is former President of Blue Origins, Amazon’s spaceflight company, and operating partner with C5. He commented:

“Axiom Space is a force in the space sector, and it will become a centerpiece of the C5 Capital portfolio and enhance our vision for a secure global future,” said C5 operating partner Rob Meyerson, who will join the Axiom Board of Directors. “The Axiom Station will be the infrastructure upon which we will build many new businesses in space, and it will serve as the foundation for future exploration missions to the Moon, Mars, and beyond.”

The next reason for an Axiom IPO? Making history…

Axiom Mission 1

On January 26, 2021, Axiom announced its crew for the first flight of private individuals. Axiom Mission 1 (Ax-1) is a historic mission because it’s the first private mission to the ISS. It will cost $55 million per person for an 8-day stay. Ax-1 plans to launch in January 2022.

The Crew

Former NASA astronaut and Axiom vice president Michael López-Alegría will act as commander. López-Alegría went to space four times in his 20-year NASA career. He last visited the ISS in 2007. López-Alegría will be the first person to command both a civil and commercial human spaceflight mission.

American entrepreneur and non-profit activist investor Larry Connor will act as pilot. Connor has led and founded organizations across real estate, non-profit and fintech sectors. He plans to collaborate with Mayo Clinic and Cleveland Clinic on research projects.

Canadian investor and philanthropist Mark Pathy is one of two mission specialists. Pathy will be Canada’s 11th astronaut. He’s collaborating with the Canadian Space Agency and the Montreal Children’s Hospital for health-related research projects.

Impact investor and philanthropist Eytan Stibbe is the second mission specialist and Israel’s second astronaut. The first was his close friend, Ilan Ramon. Ramon was killed onboard Space Shuttle Columbia in 2003. Stibbe will conduct scientific experiments in coordination with the Ramon Foundation and the Israel Space Agency at the Ministry of Science & Technology.

López-Alegría commented:

This collection of pioneers – the first space crew of its kind – represents a defining moment in humanity’s eternal pursuit of exploration and progress. I know from firsthand experience that what humans encounter in space is profound and propels them to make more meaningful contributions on returning to Earth. And as much as any astronaut who has come before them, the members of this crew have accomplished the sorts of things in life that equip them to accept that responsibility, act on that revelation, and make a truly global impact. I look forward to leading this crew and to their next meaningful and productive contributions to the human story, both on orbit and back home.

Partnerships: SpaceX and NASA

Axiom formed partnerships with two very big space names: SpaceX and NASA. SpaceX is the spaceflight manufacturer company founded by Elon Musk. It’s also the company spinning out Starlink to go public. Ax-1 will launch aboard SpaceX’s Crew Dragon. Axiom says it’s only the first of many.

Additionally, Axiom has NASA’s favor. In January 2020, NASA selected Axiom to begin building its own space station modules on the ISS. Axiom can start as early as 2024. It’s part of NASA’s project to commercialize low Earth orbit. While Axiom is building, ISS capabilities will increase until it’s decommissioned.

In its Series B announcement, Ghaffarian said:

Axiom Space was founded on the knowledge that commercial infrastructure and innovation in space would offer unique ways to improve life on Earth. Axiom’s sole-selection by NASA to connect to ISS and ability to leverage its key revenue lines are evidence of the company’s expertise and a business model that is set up to optimize across a variety of commercial on-orbit opportunities. This highly successful round is a pivotal moment for on-orbit commerce and its implications for our civilization’s potential are far-reaching.

Axiom currently has no direct competitors. That makes it a pioneer in its industry and an Axiom IPO a promising opportunity. But will investors ever see Axiom stock?

Will We See Axiom Space Stock?

It’s unlikely Axiom will go public in 2021 or even 2022. With capital investors flocking, Axiom won’t need to raise funds in an IPO. But that doesn’t mean it’s off the table.

According to Suffredini, the company did talk about an Axiom IPO, particularly as more and more companies choose to go public via SPAC IPOs. But they decided to go with Series B private funding. However, Suffredini says the company will revisit the public-vs-private conversation the next time Axiom looks to raise funds.

If you’re looking for the latest investment opportunities, sign up for our free Profit Trends e-letter! You’ll get useful tips and research straight to your inbox from our investing experts. And if IPO investing interests you, check out our IPO calendar to stay up-to-date on the latest offerings.

Although there won’t be Axiom stock any time soon, there are other space plays for investors today. Check out these three space ETFs to invest in. And don’t forget to come back to stay up-to-date on the latest Axiom IPO news.