The Power of Uninterrupted Compound Interest

It’s hard to learn this investing concept for the first time. But uninterrupted compound interest can turn small accounts into life-changing amounts. With a simple plan and enough time, anyone can become wealthy.

With the explanation and examples below, you’ll see how compound interest works. And why it’s best to leave it uninterrupted. But not only that, you’ll get some insight from some of the world’s greatest thinkers and investors. By following their lead, you can improve your returns…

What Is Uninterrupted Compound Interest?

The power of compound interest comes from reinvesting. Or more so, simply staying invested. Let’s take a quick look at this table that shows how interest compounds…

| Year | Start | Interest | End |

| 1 | $100 | $10 | $110 |

| 2 | $110 | $11 | $121 |

| 3 | $121 | $12.10 | $133.10 |

This shows how $100 grows at 10% each year. In the first year, you start with $100 and receive $10 in interest ($100 x 10%). That then gives you $110 to start with in year two…

Then a 10% return on $110 gives you $11 in interest in the second year. Each year, this continues and the interest grows. That’s assuming you let the uninterrupted compound interest continue to work for you. Some people take it out early and this lowers long-term returns.

It doesn’t amount to huge returns in the short-term, but the further out in time you go, the larger it becomes. Here’s the same example that shows years 30, 40 and 50…

| Year | Start | Interest | End |

| 30 | $1,586 | $159 | $1,745 |

| 40 | $4,114 | $411 | $4,526 |

| 50 | $10,672 | $1,067 | $11,739 |

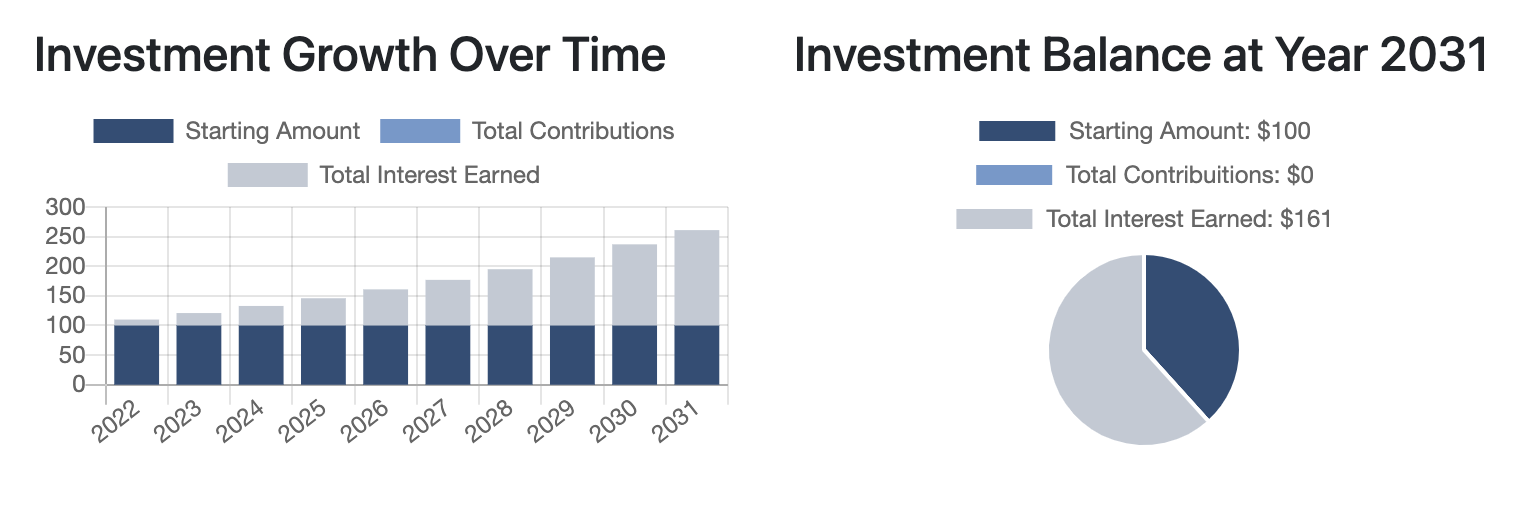

Those are some solid returns! Feel free to check out this free dividend calculator and here’s an investment calculator as well. You can try a few examples to see how your investment accounts can grow. For example, here’s a screenshot of this same investment example out to 10 years…

Best Compound Interest Quotes

The world’s best investors know the power of compound interest. To start, here’s a quote from Warren Buffett…

My life has been a product of compound interest.

If Warren Buffett stopped investing when he was 50 years old, many people might not know his name today. That’s because 99% of his wealth came after his 50th birthday. Thanks to the power of compounding, he’s seeing much higher returns in his later years in life. This isn’t because annual percentage returns are higher. Instead, it’s the change in total dollars as his portfolio grows.

And here’s some wisdom from Charlie Munger…

The first rule of compounding is to never interrupt it unnecessarily.

If you can follow this simple rule, you can grow you portfolio to new highs. It’s a simple but powerful concept that can help generate wealth passively. And going one step further, compound interest isn’t just limited to investing. This last quote is often attributed to Albert Einstein…

Compound interest is the eighth wonder of the world. He who understands it, earns it… he who doesn’t… pays it.

We tend to think linearly but many things in our world move exponentially. But I digress, let’s look at one last important piece to compounding…

Finding the Best Uninterrupted Returns

With the quotes and examples above, you see the power of uninterrupted compound interest over many years. Although, one challenge is finding the best investments…

There are many assets to choose from. For example, you have commodities, real estate, cryptos, stocks and many more. Although, over the long-term, just one of these assets tends to outperform the others…

Stocks have returned roughly 8-12% annually. There’s plenty of volatility in any given year, or even a few years. But long-term, these average annual returns beat out the other assets.

On top of that, you can buy the best stocks with zero transaction fees today and don’t have to put in any additional work. Real estate, on the other hand, comes with hefty fees, maintenance, insurance, taxes, etc. And for another comparison, commodities like gold don’t produce any ongoing value such as dividends. Gold is only worth what the next person is willing to pay for it.

Of course, each asset class has some unique benefits and it can be smart to diversify. Although, many of the world’s best investors focus on stocks and play the long-game. As you’ve now seen, uninterrupted compound interest is a beautiful thing.

If you’re looking for some of the best investment opportunities, check out these free investment newsletters. They’re packed with insight from investing experts. And as always, it’s good to continue exploring many investment ideas. Over the years, you’ll connect more dots and it can lead to even better returns.