Casino Stocks to Buy

In this article, IU Einstein Karim Rahemtulla looks at the impact the recession has had on casinos. He also identifies three potential casino stocks to buy.

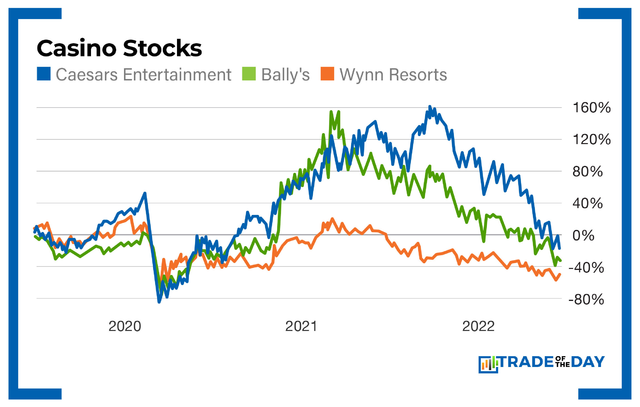

With pandemic restrictions easing up, Las Vegas and many other gambling hot spots are seeing booming business. The stocks tell a different story, though.

Casino stocks are getting hammered. Many are trading at pre-pandemic levels.

That doesn’t make much sense.

Recession or no recession, these companies aren’t going out of business – but they sure are being priced that way!

You know who is investing in casinos? Insiders. That’s who.

Casino Stocks to Buy

Insiders at Caesars Entertainment (Nasdaq: CZR) and Bally’s (NYSE: BALY) have been scooping up shares. In fact, Bally’s is trying to buy back 20% of its own outstanding shares at current levels.

Think about it for a minute… Why would insiders AND the company itself be buying shares in the open market at current and higher levels? There are three options…

- They’re stupid.

- The shares are overvalued.

- They smell a bargain.

I vote for No. 3 – and so should you.

Bear markets are famous for making people rich. That’s right – rich!

How so?

Well, as Warren Buffett (who is buying stocks in select companies right now) says, “I like my stocks like I like my socks: on sale.”

I agree.

The truth is…

Bear markets are the absolute best times to get knee-deep in stocks. And the worse things get, the deeper you should wade in.

Someone once said, “Stocks are the only thing people don’t buy when they are on sale.”

Action Plan: Right now, casino stocks are on sale. Take a look at Caesars and Bally’s if you want domestic exposure and Wynn Resorts (Nasdaq: WYNN) if you want exposure to both Las Vegas and Macau, Asia’s gambling capital!

In The War Room, we bring you longer-term opportunities like these every day. We also bring you short-term trades to take advantage of quick swings. In fact, my colleague Bryan Bottarelli has been crushing short-term trades lately. He’s posted a 90% win rate on short-term trades in 2022.