What is Net Income?

There are a lot of metrics to pay attention to when it comes to financial reporting. Few are as meaningful or as important as a company’s net income. This is the total revenue earned in a period (e.g., fiscal year) after deducting all expenses incurred during the same period. It’s a figure reported on the company’s income statement and correlates to its profitability. Net income is most commonly referred to as the company’s bottom line or its total earnings.

While it’s reported as a static figure on the company’s income statement, net income is actually more useful as a rolling metric. Companies able to bring in more money than they spend are profitable and therefore, more successful. The ability to increase net income and profitability over time signals a healthy business model. More important, it’s a positive sign for investors seeking a lucrative place to park their capital.

How to Calculate Net Income

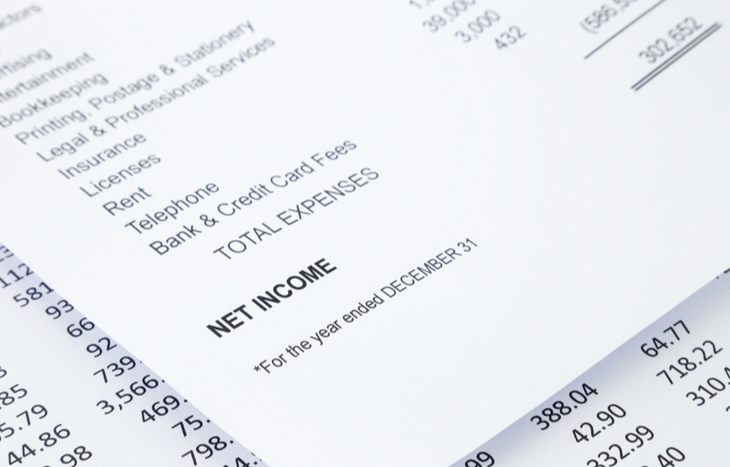

Net income comes from subtracting the company’s total expenses from its total revenue. This includes expenses such as cost of goods sold (COGS), sales and administrative costs, overhead costs, operating expenses, asset depreciation and other expenses. It also factors in the cost of taxes. The formula for net income is a simple one:

Net Income = Total Revenue – Total Expenses

Simply put: net income represents profit. It’s the measure by which a company is able to exceed its expenses by bringing in revenue. The path to this profitability is evident on the company’s income statement, which shows the breakdown of figures that attribute to both the revenue and expense side of the equation.

Net Income and Earnings Per Share

Beyond a showcase of overall profitability, net income is an important variable in calculating a company’s earnings per share (EPS). Many investors use EPS as a measure of the company’s performance over the past period. Companies also tend to issue an expected EPS: the amount by which shareholders can expect shares to appreciate in the upcoming period.

It’s also important to consider basic EPS vs. diluted EPS. Diluted EPS is the measure of the company’s net income split across common stock shares, while also factoring in dilutive events, including the exercising of employee stock options, warrants and convertible preferred stock. Diluted EPS is almost always lower than basic EPS, but tends to give a more accurate look at how the company’s net income comes back to benefit investors.

How Companies Use Net Income

Net income is money the company can use for whatever it sees fit, since all business expenses factor into its calculation. Depending on the business’ financial health or stage of growth, it can choose to do a number of things with its profit:

- Pay out dividends. Public companies pay a dividend as a way to redistribute net income to shareholders. This dividend serves to disburse profit, which attracts more shareholders, bringing more investor capital to the business.

- Retained earnings. Retained earnings are the profits the company chooses to keep on-hand after paying dividends, to boost its cash reserves. Many companies choose to retain profits when planning ahead for a known expenditure or in preparation for financial reporting, as a way to bolster the balance sheet.

- Reinvest profits. Most often, companies choose to reinvest net income back into the business. This can include the purchase of new equipment, expanding the means of production, adding new assets or making acquisitions.

How the company puts its profits to work can factor heavily into how investors view it as an investment. The choice often comes down to the company’s forward-looking objectives, leadership philosophy and upcoming financial obligations.

An Example of Net Income at Work

ABC Company saw a total revenue of $2.5M in 2020. The company had business expenses of $1.2M and paid taxes of $300,000 over that same period. The net income for ABC Company in 2020 was $1M.

ABC Company pays out $600,000 of that income as dividends to shareholders, resulting in $400,000 in retained earnings. Of those retained earnings, the company chooses to spend $100,000 on new production equipment and $150,000 on R&D initiatives for the upcoming year, putting the final $150,000 in the bank.

Investors looking at ABC Company’s financials over the past three years will see net income growth: $900,000 in 2018, $1M in 2019 and $1.2M in 2020. This healthy growth, in addition to how the company handled its profits, points to ABC Company as a smart investment.

Important Factors to Consider

Like all financial metrics, net income is subject to some level of manipulation. It’s important for investors to look past the bottom line number, to examine the factors contributing to it. Do the company’s expenses make sense? Do its revenues align with the sales figures reported? While financial reporting standards and auditing guarantee a level of transparency in financial reporting, the burden of understanding them still falls to investors.

Companies With Consistent Profit are Successful

Net income is synonymous with the bottom line for a reason: because it’s the end-all, be-all of the company’s ability to make money. Companies that show consistent net income period-over-period are going to attract investors. Why? Because they continue to prove the efficacy of their business model.

And these are the types of companies you want to invest in as you close in on retirement. To learn more about making smart investments and preparing for retirement, sign up for the Wealthy Retirement e-letter below.

Companies that make money are able to pay it back to shareholders, or reinvest it for even larger future profits. However it’s used, the fact that the business is profitable matters above all else.