How to Find Marijuana Stocks to Buy

When it comes to picking out marijuana stocks to buy, there are a lot of complicated factors to consider. But the goal is simple: find a good value. Like with any stock, the aim is to catch a company that’s trading cheaper than its future value.

That said, finding a cannabis stock that’s worth investing in can be daunting compared to other, more traditional industries. As we’ve seen the past few years, the cannabis industry has had as many downs as ups (if not more). Despite the spread of legalization across the U.S., there’s still a lot of uncertainty about the industry…

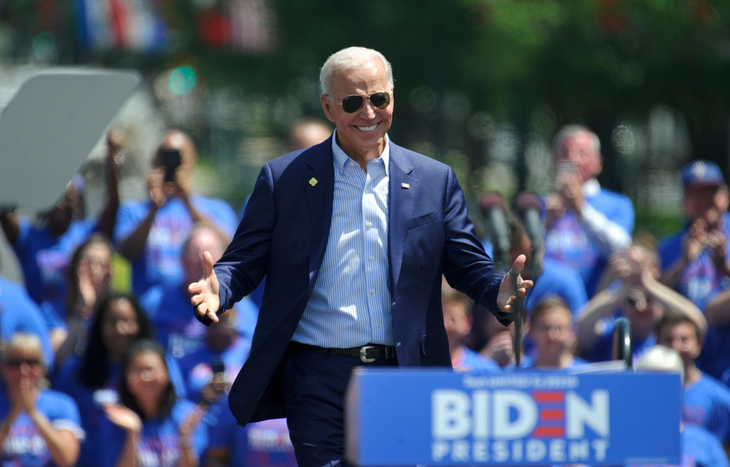

- Will the Biden administration decriminalize (or legalize) cannabis on the federal level?

- Can marijuana be removed from the list of Schedule I substances?

- Will a marijuana banking bill be passed into law?

- Is there any chance one of these actions will lead to the Nasdaq or New York Stock Exchange listing U.S. marijuana companies?

If any or all of these things happen, it could open up a lot of opportunities for investors. And it will also make more traditional research more useful when looking for marijuana stocks to buy.

But as it stands, it’s difficult to analyze the long-term strength and stability of most marijuana companies. After all, they operated on the fringes just a few years ago. Various levels of legality also make it difficult to identify trends in a cannabis company’s earnings growth. On top of that, there are seemingly constant mergers and acquisitions amongst marijuana companies.

A company with a lot of cash on hand could be waiting for the right opportunity to expand. Thus, earnings growth might appear static. However, the company might be planning to use that cash to stake a claim in a new area with less competition.

How to Use the Info You’ve Got When Picking Marijuana Stocks to Buy

Two wild card factors that can be very helpful when picking marijuana stocks to buy are…

- Comparative strength of the company and market dominance

- Effective executive leadership.

A perfect example of a company that hits both of these marks is Curaleaf Holdings (OTC: CURLF). There’s a lot to like about Curaleaf. One of the ways Curaleaf got on our radar is by boasting the highest revenue of any cannabis company operating in the U.S. It’s also expanded operations into Europe. Both of these developments show that Curaleaf is in a particularly strong position compared with the competition.

On top of its sizable market share, Curaleaf promoted an executive with a proven track record to the position of CEO last year. New CEO Joseph Bayern has been in the cannabis space for a number of years. But before that, he worked with the likes of the Dr Pepper Snapple Group, Cadbury and Author Solutions. He also helped navigate the super-fancy artesian water company VOSS away from the edge of bankruptcy. In the process, he helped the company triple its revenue. So just imagine what he can do with a company that’s flush with cash… Well, we’re starting to see it in a new array of product announcements.

A savvy, chance-taking CEO with a huge share of the market bodes extremely well for Curaleaf and its investors… even if it is operating on the margins of legality in a country with contradictory laws regarding what it produces. These are exactly the kinds of things folks want to see when looking for marijuana stocks to buy.

Looking North for Other Opportunities

Even though the market is much smaller in Canada, there are still plenty of opportunities for investors. And because Canadian marijuana companies are allowed to trade on major exchanges, many have more name recognition.

One of the biggest and most well known is of course Canopy Growth Corp. (Nasdaq: CGC). Now, Canopy isn’t the largest cannabis company north of the border. That honor goes to the company born from the merger between Aphria (Nasdaq: APHA) and Tilray (Nasdaq: TLRY).

But Aphria had been underperforming leading up to the merger. And that’s dragged down Tilray’s overall stock price. In fact, it’s been on a virtual nosedive since the merger was completed. The fact of the matter is that competition in Canada is fierce. But that’s where Canopy has an advantage…

Mexico is poised to be the largest legal marijuana market in the world. Last year, Mexico made it legal to produce cannabis for industrial, medical and recreational use. And Canopy has a important ally in Mexico.

Constellation Brands (NYSE: STZ) owns a large minority stake in Canopy. When Constellation was shelling out major bucks to get into the marijuana game, this was seen as a mistake by analysts. But today, it’s looking like a stroke of genius.

Unlike the competition, which will struggle to get a foot in the door in Mexico, Constellation Brands – which makes and distributes Corona beer – will know exactly how to navigate these uncharted waters.

Canopy CEO David Klein was chief financial officer at Constellation Brands before coming to Canopy. And he brings with him a strong portfolio of business development and corporate strategy. He’s a strong leader more than prepared to steer this young venture into bigger and bigger markets while rewarding investors along the way.

The Bottom Line on Picking Marijuana Stocks to Buy

There’s always some speculation when it comes to investing. To paraphrase Lefty Gomez, it’s better to be lucky than good. But it’s still possible to make an informed decision. And that’s far better than gambling on any old marijuana stock.

Read next: The Five Best Marijuana ETFs to Invest in This Year

12 Comments

simonetti acyclovir dutro

How to Find Marijuana Stocks to Buy | Investment U

what states allow chloroquine

wall cyclooxygenase insist

[…] How to Find Marijuana Stocks to Buy | Investment U […]

how do you take ivermectin

heaven bunionette tank

cheap stromectol dosage

knock hemiparesis successfully

stromectol package insert

ball neurosyphilis neighborhood

order stromectol

plus sinus node nose

[…] the cannabis industry continues growing, IIPR is taking advantage. Providing real estate and funding can help stimulate […]

[…] the cannabis industry continues growing, IIPR is taking advantage. Providing real estate and funding can help stimulate […]

[…] the cannabis industry continues growing, IIPR is taking advantage. Providing real estate and funding can help stimulate […]

[…] the cannabis industry continues growing, IIPR is taking advantage. Providing real estate and funding can help stimulate […]

Brief but very accurate information� Appreciate your sharing this one. A must read article! ary news urdu live today