The Five Best Marijuana ETFs to Invest In This Year

When Cronos Group (Nasdaq: CRON) started trading on Wall Street in 2018, it was a watershed moment. For the first time ever, investors were offered a pure marijuana play in the markets. In the years since, scores of other marijuana companies have joined the ranks of Cronos. Today, there are even marijuana ETFs available.

Since the early groundswell in marijuana investing, there’s been a lot of jockeying for position, but no clear front-runner. In fact, since Tilray’s (Nasdaq: TLRY) wild ride shortly after its IPO, pot stocks as a whole have been pretty mellow. But values should be on the rise…

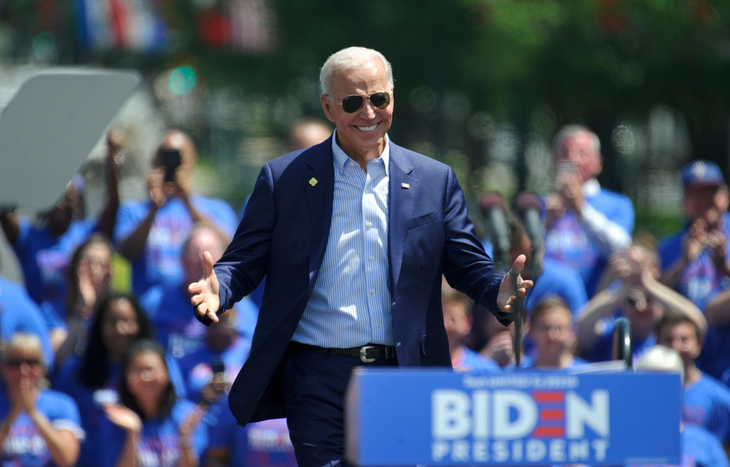

Since the new year, many of the larger marijuana stocks have been quietly ticking upward. Once again there are whispers in Washington about the possibility of federal legalization. Whether the Biden administration chooses to move the goalpost in that direction has yet to be seen. But with or without a federal ruling, one thing is for certain: People are shelling out big bucks for bud across the country.

It’s estimated medical marijuana sales will break $25 billion by 2025. Within just a few years, medical and recreational marijuana is expected to be close to a $40 billion industry. Growth like that is hard to ignore. And it’s high time investors take notice.

The big question is what company (or companies) will break out? Will there be a Coke vs. Pepsi type rivalry? Or will it appear more like the automotive industry with several companies becoming household names?

Betting on one stock is a gamble. Even those who litter their portfolio with pot stocks aren’t guaranteed a piece of the $40 billion action. This is where the benefit of marijuana ETFs come in. They do the diversification for you.

The Five Best Marijuana ETFs to Invest in This Year

AdvisorShares Pure US Cannabis ETF (NYSE: MSOS)

At the top of our list is MSOS. One of the reasons it tops out our list is that it is the only actively managed ETF dedicated solely to U.S. cannabis exposure. Because MSOS focuses exclusively on the largest marijuana market in the world, the U.S., the potential here is extraordinary.

The other appeal here is that MSOS holdings are well-diversified. Its holdings include growers, dispensaries, pharmaceutical companies and biotech firms focused on marijuana use. It also includes real estate companies focused on marijuana and developers of consumption devices and hydroponic growing systems. This gives investors exposure to the marijuana industry at every stage.

If weed grows anywhere near as popular in the coming years as is expected, MSOS will be in a unique position to reward shareholders. Which is why this is one of our favorite marijuana ETFs to consider investing in.

ETFMG Alternative Harvest ETF (NYSE: MJ)

The MJ ETF is the largest one available that targets the global cannabis industry. And it gets bonus points for being the first ETF in the U.S. to target the industry.

Its top holdings are some of the biggest in the Canadian cannabis space. They include the likes of Tilray, Canopy Growth Corp (Nasdaq: CGC) and Aphria (Nasdaq: APHA) – which reached profitability faster than any of its Canadian peers.

But it’s the sheer diversity of holdings that makes MJ so appealing. The fund has exposure to agriculture products, biotech, growing products and paper product industries. And it has exposure in Canada, the U.S., the United Kingdom, Sweden and Japan. If cannabis markets tick upward anywhere, MJ holders will see the benefit. And that makes this an excellent cannabis ETF to invest in and hold on to for a few years.

Cambria Cannabis ETF (OTC: TOKE)

This ETF is one of the new kids on the block. But what it lacks in age it makes up for in value. TOKE is one of the cheapest marijuana ETFs out there. That’s not enough to make it onto this list though.

The real reason TOKE is so appealing is because of Cambria’s founder and Chief Investment Officer, Meb Faber. Faber is a classic value investor. And because TOKE is his firm’s only sector-focused fund, there’s good reason to believe the sector remains undervalued… at least for now. Faber’s thoughts on the cannabis industry are pretty transparent. Public perception of weed has shifted. And as sales move away from the black market, growth potential in the sector is still far from realized. And that makes this one of the most promising marijuana ETFs available.

AdvisorShares Pure Cannabis ETF (NYSE: YOLO)

This ETF is designed to invest for pure cannabis exposure. It primarily invests in small cap and midcap cannabis companies around the world. And at least 50% of revenue from any of the holdings in YOLO come from the marijuana and hemp industry.

The official breakdown in holdings by region focuses on North America… which makes sense because that’s where the most movement in the market is. But this ETF’s outlook is favorable because of its diversity of sector exposure. As a long-term play, YOLO looks promising like a promising cannabis ETF, especially if legalization continues to spread.

Cannabis ETF (NYSE: THCX)

Unlike the other ETFs on this list, THCX is a passively managed fund. But it is also a pure play in the cannabis sector.

THCX tracks the Innovative Labs Cannabis Index – which is a rules-based portfolio that rebalances on a monthly basis. The whole reason behind the inception of THCX was to offer investors an easy way to gain exposure to stocks that are most likely to benefit from growth in the hemp and marijuana industries. And looking at the fund’s holdings shows that it does so in spades.

As a bonus, THCX has also started issuing dividend payments to investors. While the $0.87 per share distributed over the last four quarters might not sound like much, the possibility of future growth makes this dividend-paying marijuana ETF even more appealing.

The Bottom Line on Marijuana ETFs

The cannabis industry struggled for years after it came out of the gate a little too hot. This growing industry has already undergone the longest bear market in its history.

Investors are already piling into the big names in the industry. But these five cannabis ETFs are a cheaper and more diversified way in. And the way they’re set up all but ensures great earnings potential as sales and legalizations increase.

5 Comments

[…] other benefit of MSOS is that it has very well-diversified holdings. Its holdings include growers, dispensaries, pharmaceutical companies and biotech firms focused on marijuana use. If the […]

[…] https://dev2.investmentu.com/marijuana-etfs/ 11 […]

[…] Are cannabis etfs good? […]

[…] https://dev2.investmentu.com/marijuana-etfs/ […]

Great information shared.. really enjoyed reading this post thank you author for sharing this post .. appreciated