Are You Ready to Retire?

Do you think you’re ready to retire?

If you are, you’re distinctly in the minority.

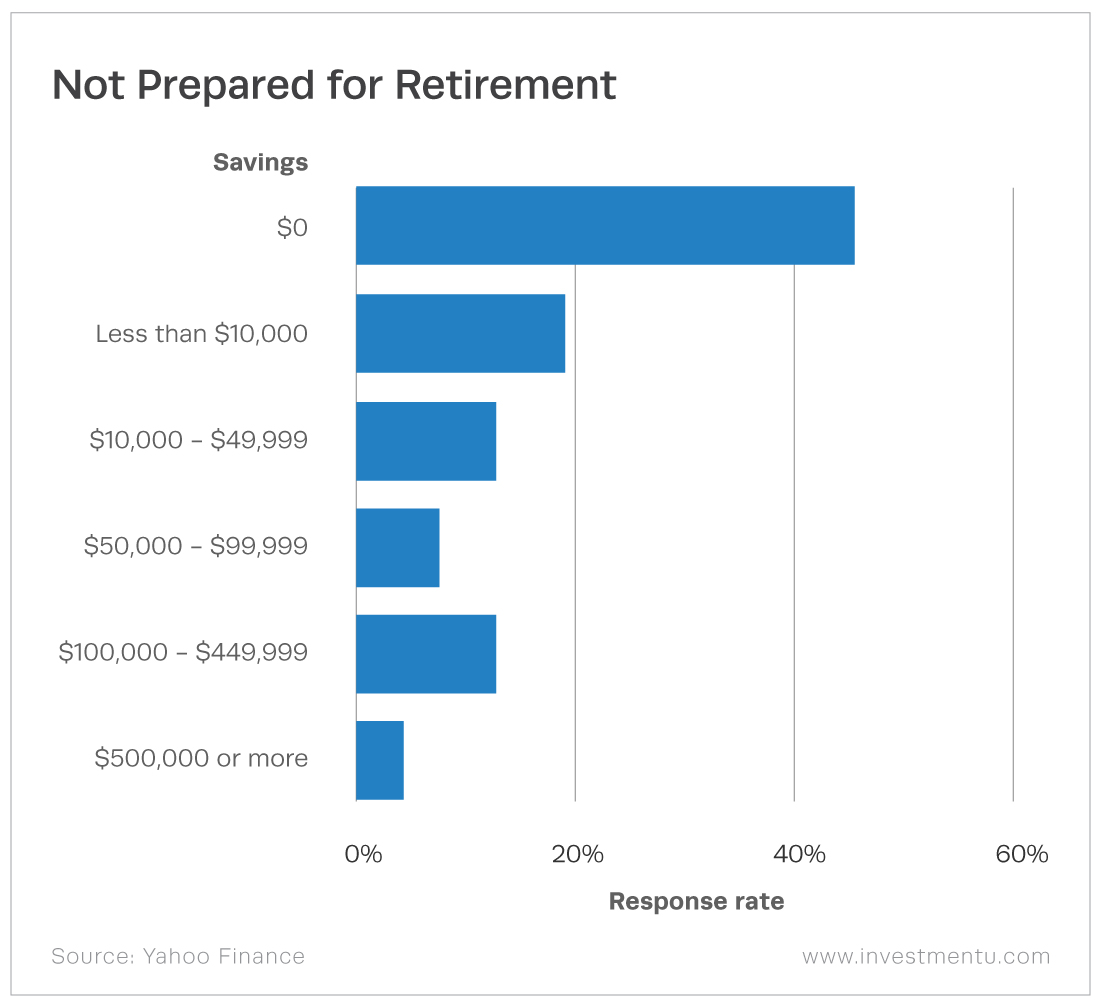

According to a recent survey by Yahoo Finance, 64% of Americans are likely to retire with less than $10,000 in their retirement accounts. And almost half of those surveyed said they had no money put aside for retirement. None. Zero. Zilch.

Take a look at a graphic illustrating the results of that extremely worrisome survey.

It’s possible that a lot of these people are counting on Social Security to fund their retirement. But that’s a very bad idea. Keep in mind that Social Security was created distinctly to keep elderly Americans out of poverty. Nothing more.

To be sure, it does a great job of that. Without the program – one of the most popular government projects in U.S. history – about 38% of older Americans would have income below the poverty line.

But that’s all that Social Security will do: Keep you out of poverty.

Do you want to enjoy your retirement years? Travel? Treat your grandchildren to enjoyable outings and vacations? Dine at restaurants with good friends?

Social Security will not pay for those things. It will put basic food on the table and help pay rent, and that’s it. The estimated average Social Security benefit this year is about $1,500 a month, or $18,000 a year, according to AARP. That doesn’t even come close to a living wage in the U.S

To Be Ready to Retire, You Need to Start Now

It doesn’t matter how old you are. You could be just starting your career and think you have plenty of time. Don’t think like that, you need to start now.

So if you think that you, like the majority of Americans, are not doing enough to ensure a comfortable retirement, there are many actions you can take today to ensure you’ll be ready to retire.

First, adopt these six retirement habits right now.

- Establish your retirement goals

- Take advantage of your 401(k)

- Pay off your debt

- Set a budget

- Maximize your Social Security benefits

- Focus on building wealth

There’s much more about those on the Investment U website, and it’s a great place to start.

There are multiple ways to save for retirement. From Individual Retirement Accounts (IRAs) to 401(k) plans, and many more. We’ve got a great rundown of them here. Are you self-employed? We’ve got that covered, too. Right here. It’s easier than you think to set it up.

So don’t wait. Start today.

Our team here at Investment U has everything you need to know to join that smart minority of Americans ready to retire into their golden years.

How are you feeling about your retirement savings? Do you have any questions or concerns about saving for your retirement? Don’t fret, we’re here to help. Just click here to drop me a line, and I’ll be sending out a special Q&A edition of Investment U soon.

Be sure to check your email tomorrow for more up-to-the-minute insights from Investment U’s top market experts.

Enjoy your day and stay safe,

Matt