Is Cash About to Be Banned?

There is a big discussion happening on social media right now regarding cash and how it’s become a relic of the past. It might even be confiscated and replaced with crypto or computerized currency that can be tracked.

If this ends up being the case, that means no more bags sealed in plastic buried in the back yard…

No more paying the babysitter under the table…

It’s all going to be tracked.

But until that happens, there is still a place for companies like Diebold Nixdorf (NYSE: DBD). It’s a multinational financial and retail technology company that specializes in the manufacturing of ATMs, along with a host of other self-service transaction systems. And War Room members just closed out gains of more than 100% on it!

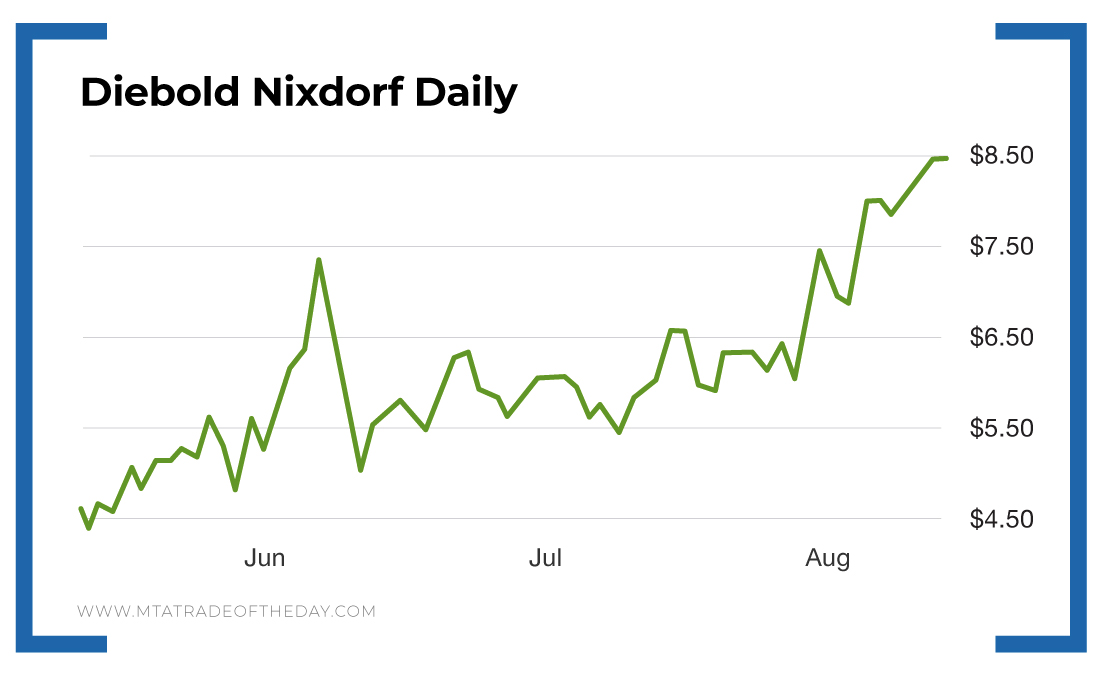

As you can see from the chart below, people thought that Diebold Nixdorf only made ATMs – which are important for sure. While some believe cash to be a relic, it’s actually the dominant form of payment in a big chunk of the world, especially for transactions of less than $50.

Investors were betting that Diebold Nixdorf would see its business dry up as people stopped going out and touching those dirty ATMs.

What they didn’t count on was how much extra cash was going to be pumped into the system.

Just counting extended unemployment benefits between March and the end of July, an extra $250 billion was injected into the economy.

Even though that cash made it to some ATMs, that was not where Diebold Nixdorf made its mark. You see, the company turned out to be a coronavirus play too. Diebold makes a lot of self-service checkout machines that you see at grocery stores and places like Home Depot.

One thing people don’t want to do right now is have contact with another human.

Diebold has a bright future, which definitely showed in its better-than-expected earnings and outlook.

In The War Room, we had LEAPS options on Diebold, and members really rang the register.