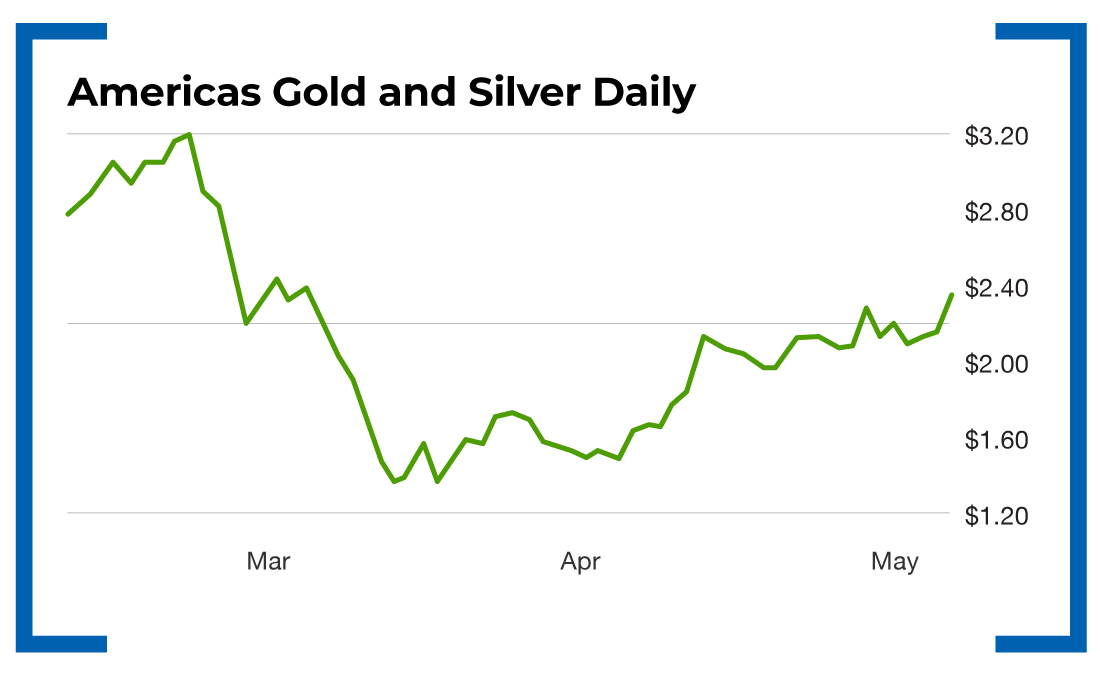

Two Gold Tycoons Are Loading Up on This $2.30 Stock

Oftentimes, when a company issues stock, its share price plunges…

This is usually a sign of weakness – a company that needs capital to continue operations. And that money does not come cheap.

In fact, for small caps and microcaps, that money might come at a 15% to 40% discount to the market price. And the shares should soon follow lower. After all, if the company is willing to take a haircut, why should you as a shareholder be willing to hang on at higher prices?

If you’re in the right situation – in the right company – a capital raise might be your opportunity to load up.

Let’s take Americas Gold and Silver (NYSE: USAS) as an example…

War Room members are in the shares well under $2, and they plan on making a bundle on the position.

Take a look at this press release from the company earlier this week…

TORONTO, May 5, 2020 – Americas Gold and Silver Corporation (“the “Company”) (TSX:USA; NYSE American: USAS) has today entered into an agreement with a syndicate of underwriters pursuant to which the Underwriters have agreed to purchase on a bought deal basis 8,930,000 common shares of the Company (the “Common Shares”) at a price of C$2.80 per Common Share (the “Offering Price”), for aggregate gross proceeds of approximately C$25,000,000 (the “Offering”). Strategic investors led by Pierre Lassonde and Eric Sprott have indicated that they intend to subscribe for such number of common shares from the offering totaling C$8.75 million.

Ordinarily this would be worrisome. However, in this case, it’s not.

Here’s what I told War Room members…

The deal is a bought deal. That means they already placed the shares and did not have to “look” for buyers. It’s good for the company, as it is selling shares AT THE MARKET – with no discount. When a company needs to raise money, it’s usually at a discount to market, and that discount for a microcap can be anywhere from 15% to 40%. These two giants of the industry are buying EVEN more shares – they already are the two largest shareholders. Lassonde, if you are not familiar, is a billionaire who co-founded Franco-Nevada. And Sprott is a billionaire who founded Sprott Inc.

Americas Gold and Silver shares fell to almost $2 on the news but stayed there only for a couple of hours. Today, the stock traded as high as $2.40, up almost 20% just two days later.

Action Plan: Companies like Americas Gold and Silver don’t need the money.

This capital raise was an opportunity for majority shareholders to be rewarded with a big chunk of cheap stock at low prices, without moving the market.

They’re not the only ones to benefit… War Room members got in this play at much lower prices.