How We’re Covering Our #$$ During This Market Uncertainty

What makes the stock market so fascinating is that you can make money no matter which direction it moves…

Bryan Bottarelli, The War Room’s Head Trade Tactician, has been showing members how to do just that with a mix of picks that have been killing this market day after day. He does it by playing short-term moves up and down, buying calls when the market goes up and buying puts when it goes down.

That’s balance!

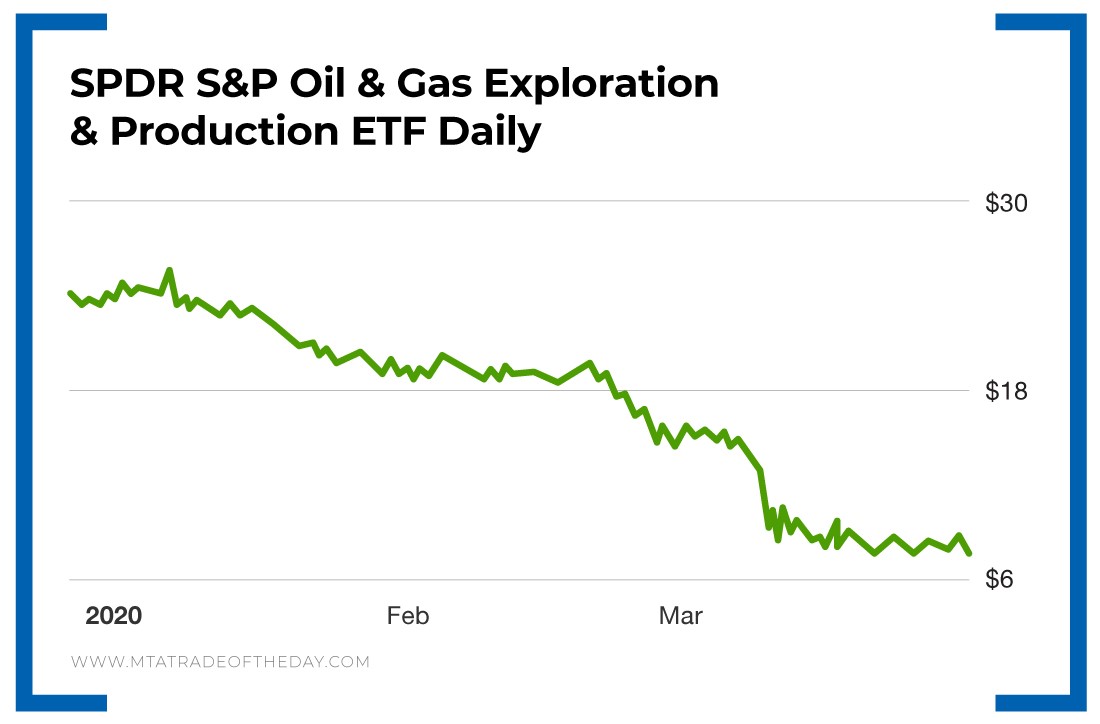

Regarding longer-term trades, members took a position in the SPDR S&P Oil & Gas Exploration & Production ETF (NYSE: XOP) after oil and energy prices crashed. Through a series of timing buys and selling covered calls, members are looking to book short-term gains from this position or reduce their cost on it even more significantly.

And they received a nice dividend to boot!

When you enter a covered call trade, you either already own the stock or buy the stock. Once you’ve entered the trade, you sell options against the stock.

When you sell an option, you receive a premium for selling it. That premium is yours to keep. It reduces your cost basis in the shares.

But, for that offset, you cap your upside as well. For example, if you own stock XYZ for $8 and you sell an option with a strike price of $10, which is trading for $1, against your stock, you limit your upside to $10.

You also receive $1, which reduces your cost to $7. If the stock closes at $10 or above, the market automatically takes the shares out of your account. If it does not close at or above $10, you keep the shares. The premium is always yours to keep.

The same concept can be applied to other options trading strategies…

You can buy one option and sell another option against it. This is commonly known as a spread trade, but it’s essentially the same concept.

Action Plan: We have ALL the bases covered in The War Room: options, stocks, ETFs, short plays, long plays, microcaps and Long-Term Equity Anticipation Securities.

It doesn’t matter what the market throws at us, we have a solution and can act fast so our members are able to take advantage of every opportunity.

Despite this crazy market, The War Room is firing on all cylinders, taking short-term gains and positioning members for some longer-term profits at bargain prices. If you want to start profiting like our members during this crazy market uncertainty, join me in The War Room today!