Warren Buffett’s Favorite Indicator Is Flashing Red

- Warren Buffett will never bet against America, but he does trust certain indicators to tell him when to hold back.

- Today, Nicholas Vardy explains what Buffett’s favorite indicator means for the U.S. market in the years ahead.

“For 240 years, it’s been a terrible mistake to bet against America, and now is no time to start.”

– Warren Buffett

Warren Buffett is no pessimist.

He believes that the American economy will continue to deliver growth and prosperity. And Buffett would never bet against America in the long run.

But today, as investors are gripped by greed and the U.S. stock market hits new highs… Buffett has been reticent about the prospects of the U.S. stock market over the coming decade.

None of us can get inside Buffett’s head.

But his actions speak louder than his words. Those actions all point in one direction: Buffett believes that the U.S. stock market is overvalued.

And he is positioning himself to exploit the opportunities in a coming market crash.

Buffett’s Favorite Market Indicator

Warren Buffett has called one specific measure “probably the best single measure of where valuations stand at any given moment.”

And this measure is the ratio of total market capitalization (TMC) to gross national product (GNP).

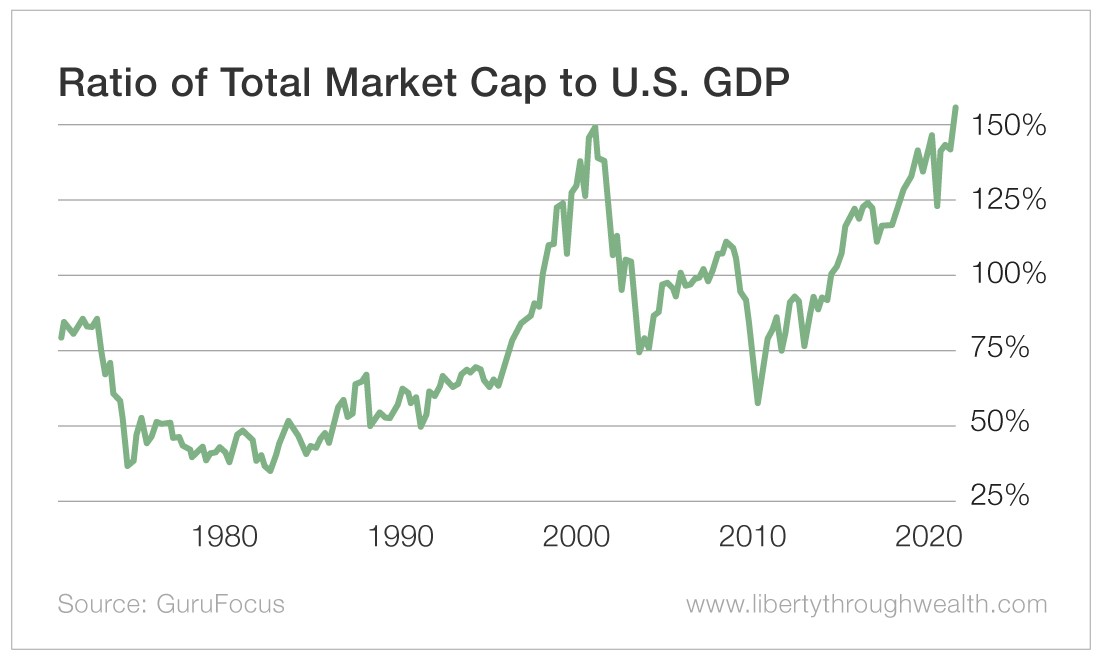

Over the past four decades, the TMC-GNP ratio has varied widely.

The lowest point was about 35% in 1982. The U.S. stock market had been stagnating since 1966.

The highest point was 148% during the peak of the tech bubble in 2000. Over those 18 years, the U.S. stock market enjoyed a massive bull market.

The market went from extremely undervalued in 1982 to extremely overvalued in 2000.

Buffett’s Record Big-Picture Calls

Buffett is famously indifferent to Mr. Market’s daily mood swings.

At the same time, he has a laser-like focus on the big picture.

Let’s look at some of Buffett’s big-picture market calls from the past…

Dot-Com Bubble

The dot-com bubble was nearing its peak in November 1999. The Dow was trading at 11,000. The U.S. stock market had gained a remarkable 12.9% a year between 1981 and 1998.

About the prospective returns of the U.S. market, Buffett said…

I’d like to argue that we can’t come even remotely close to that 12.9%… [I expect] 4% in real terms. And if 4% is wrong, I believe that the percentage is just as likely to be less as more.

Dot-Com Crash

Two years later, the Dow was down to 9,000. And Buffett wrote, “I would expect now to see long-term returns run somewhat higher, in the neighborhood of 7% after costs.”

Post Global Financial Crisis

In October 2008, Buffett wrote…

Nine years have passed since the publication of the article of November 22, 1999, and it has been a wild and painful ride for most investors; the Dow climbed as high as 14,000 in October 2007 and retreated painfully back to 8,000 today.

Buffett’s prediction? “Equities will almost certainly outperform cash over the next decade, probably by a substantial degree.”

Sure enough, the S&P 500 bottomed five months later in March 2009.

And U.S. stocks embarked on a decadelong bull run.

Prospects for the Market

What does Buffett’s favorite indicator tell us about the outlook for the U.S. stock market?

Today, the total market cap of U.S. markets stands at around $33.5 billion. That equates to roughly 155% of its gross domestic product (GDP).

The ratio of TMC to GDP has never been higher… and has even surpassed the height of the dot-com boom.

(The chart above compares TMC with U.S. gross GDP, not GNP. Although GNP is different from GDP, the two numbers are within 1% of each other.)

So what can you expect the stock market to return in the coming years?

Analysts’ models vary.

But all agree that a combination of interest rates, corporate profitability and market valuation determines long-term stock market returns.

And their models come to the same conclusion: U.S. market returns over the next decade will be flat to negative.

Here’s What Buffett Is Thinking

Buffett has yet to opine publicly about the U.S. stock market’s prospects.

But again, his actions speak louder than his words.

Berkshire is sitting on a $128 billion pile of cash. And unlike, say, Apple (Nasdaq: AAPL), Berkshire Hathaway (NYSE: BRK-B) is not actively buying back its own shares.

Buffett has his eye on his favorite indicator. And it’s flashing red.

That’s why Buffett is holding on to his cash, ready to swoop in after any market crash.

Warren Buffett may never bet against America. But he will bide his time until he can get a good price on it.

Good investing,

Nicholas

Interested in hearing more from Nicholas? Follow @NickVardy on Twitter.