Should You Bother Investing in Emerging Markets?

- In the 1990s, emerging markets earned top returns, but the picture looks a lot different today.

- Nicholas Vardy discusses whether emerging markets should be part of your ETF portfolio.

Emerging markets investing has an image problem.

I say that with a heavy heart. After all, I earned my investment spurs in the 1990s as an emerging markets mutual fund manager.

It was an exciting time.

The Soviet Union had been wiped off the map. China was about to join the World Trade Organization. Emerging markets around the world were embracing capitalism. The buzzword of the day was “convergence.” All the world’s nations were on the straight and narrow path to the free market ideal.

I flew to Kyiv, Ukraine, to tour a new Coca-Cola (NYSE: KO) bottling plant. I met with a former MIT professor who was CEO of the national telecom company in Greece. I even traveled to Bishkek, Kyrgyzstan, to meet with the exuberant 26-year-old head of its stock exchange.

Sure, all this made for good stories when I pitched our fund to investors in Switzerland and Monte Carlo. But let’s be honest…

Investors weren’t interested in emerging markets for my stories. They were interested for the same reason Willie Sutton robbed banks: “That’s where the money was.”

The Rise and Fall of Emerging Markets

U.S. investors recall the dot-com boom of the late 1990s with some nostalgia. It, too, was a heady time.

In the four years between 1995 and 1999, the S&P 500 Growth Index rose by an average of 35.2%.

But emerging markets were an even better place to make money in the 2000s.

In the five years from 2003 to 2007, emerging markets were the world’s top-performing asset class, averaging a 37.8% annual return.

The popularity of emerging markets exploded with a memorable acronym, “BRIC.” Coined by Goldman Sachs’ Jim O’Neill, BRIC stands for Brazil, Russia, India and China.

O’Neill’s message? BRIC was destined to take on the mantle of global economic leadership from the United States and the West.

Investors piled into ETFs that invested exclusively in these red-hot markets. Even my Hungarian father-in-law – a military attaché at embassies throughout the Middle East – invested in a BRIC fund.

Then the emerging markets story unraveled. Emerging markets tumbled 53.19% in 2008 in the wake of the global financial crisis.

Yes, the asset class recovered an impressive 79.02% in 2009. But except for 2017, emerging markets have been dead money.

Had you invested in the iShares MSCI Emerging Markets ETF (NYSE: EEM) the day the market bottomed on March 8, 2009, you’d be sitting on just under a 50% gain.

Invest the same in the U.S. stock-based Vanguard Total Stock Market ETF (NYSE: VTI), and you’d be up 260%.

How to Best Play Emerging Markets

The single best strategy to invest in the U.S. market over the past decade has been to “buy and hold.” (Or, as we said in my fund manager days, stay “dumb and long.”)

That simple strategy has beaten Warren Buffett over the past decade.

Alas, it has not worked in emerging markets.

Instead, the key to success in emerging markets has been a focused, “rifle shooter’s” approach.

What does this approach entail?

Pick the markets with the most positive momentum. And take your profits quickly as soon as you make some gains.

So where should you be aiming your investing rifle today?

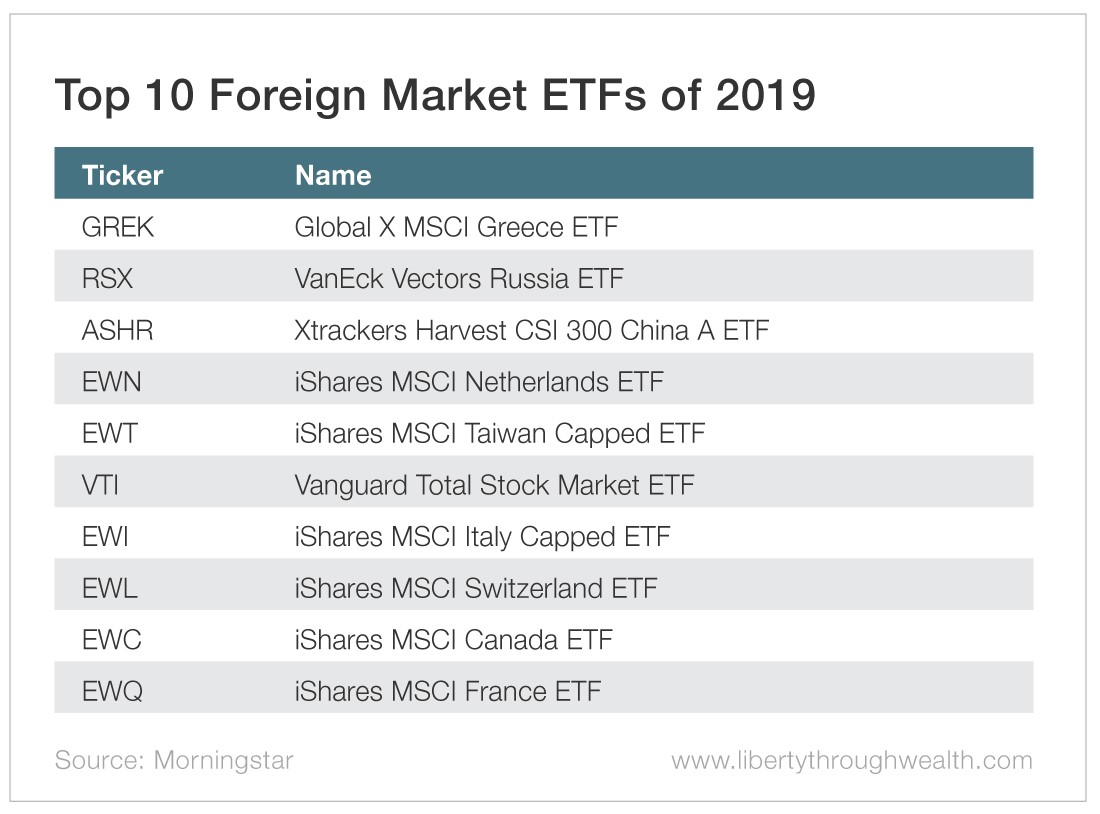

I currently follow the performance of 47 global stock markets by tracking their related ETFs. As we near the end of 2019, the three best-performing foreign market ETFs I track are Greece, Russia and domestic Chinese stocks.

That’s a diverse group of stocks. And I bet none were on your buy list at the start of 2019.

The real question: Is trying to rifle shoot the world’s best-performing markets worth the effort?

After all, the U.S. stock market has continued its remarkable run.

As measured by the Vanguard Total Stock Market ETF, it ranks No. 6 among all global markets in 2019. Even more impressively, it ranks No. 1 across three-, five-, 10- and 15-year periods.

It’s reasonable to ask, “Why bother?”

I am of two minds on this.

On the one hand, there will be a day when the U.S. stock market relinquishes its crown. And emerging markets are both a value investor’s and a contrarian investor’s dream.

On the other hand, I don’t see a catalyst for their return on the horizon.

The bottom line?

I know emerging markets stocks will one day come back in favor.

But that day is not here yet.

Good investing,

Nicholas

Interested in hearing more from Nicholas? Follow @NickVardy on Twitter.

3 Comments

[…] in green hydrogen technology. So this would appear to be a good bet for the future. But as with any emerging industry, there is always a caveat, or more. We’ll take a look at how Plug Power stock is doing and […]

[…] in green hydrogen technology. So this would appear to be a good bet for the future. But as with any emerging industry, there is always a caveat, or more. We’ll take a look at how Plug Power stock is doing and […]

[…] in green hydrogen technology. So this would appear to be a good bet for the future. But as with any emerging industry, there is always a caveat, or more. We’ll take a look at how Plug Power stock is doing and […]

Comments are closed.