The Industry You’ll Feel Good About Investing In

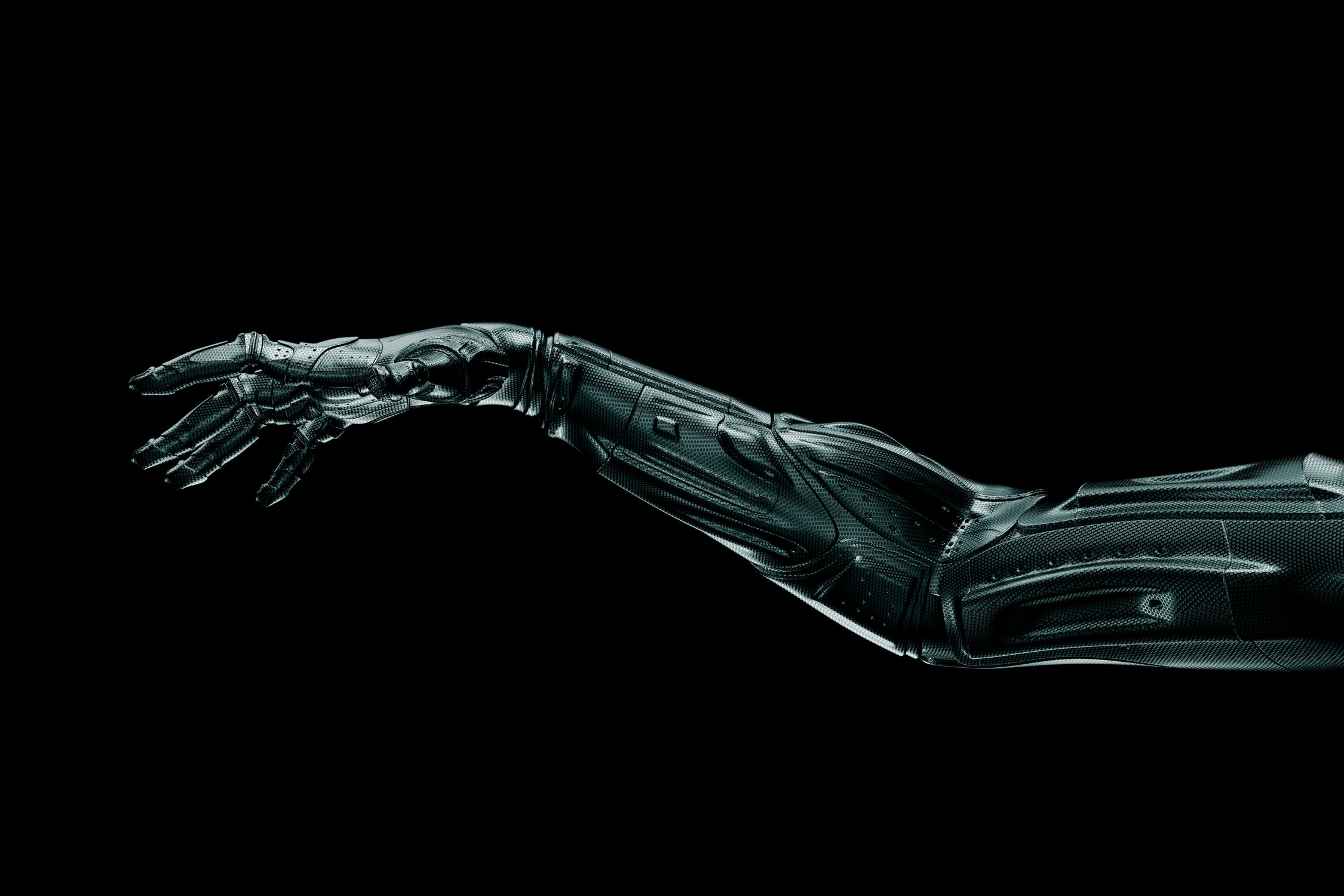

James Sides – a staff sergeant and explosive ordinance disposal expert in the U.S Marines – may have lost his hand during a 2012 deployment to Afghanistan, but the explosion didn’t take his determination.

According to a story in Marine Corps Times, it was that strong mental drive that made him the perfect candidate for a new prosthetic technology known as the implantable myoelectric sensor, or IMES, which allows the muscles in the upper arm to control a state-of-the-art prosthetic hand with remarkable ease.

Sides’ story is but one example of how developing technology can benefit amputees – many of which are weary of war. As early as 2012, more than 1,500 combat veterans had lost a leg, arm or more overseas. At the height of the attacks in 2011, says the Army Times, 240 service members had to have either an arm or a leg amputated.

Indeed, during Operation Iraqi Freedom and Operation Enduring Freedom, the amputee rate has doubled from past wars. As such, there is a ready-made market for cutting-edge prosthetics – one that is expected to top $23.5 billion by 2017, thanks to the proliferation of joint disease, increased medical care in developing countries and an aging world population.

Receiving the latest prosthetic may give recipients a new lease on life, but investing in the future of others can be an exciting affair, too. Check out our top aspiring prosthetic companies worth investing in.

Smarter Prosthetics

Thanks in part to the growing popularity of smartphone technology and Bluetooth communications, traditional prosthetic devices are also taking a turn for the more advanced, such as the “SmartPuck” prosthetic limb socket with integrated vacuum suspension from 5280 Prosthetics, a privately traded startup out of Colorado that allows amputees to remotely interface with their prosthesis using an iPhone, iPod or Apple computer.

In a move signaling further expansion and possible public trading, the company welcomed Chris Wilson as the company’s first-ever director of sales. Previously, Wilson served as an area manager with the world’s second-biggest prosthetics producer, Ossur HF.

5280’s expansion could be beneficial for Apple, as well – the prosthetics company signed an exclusive deal to distribute SmartPucks solely with Apple products. If 5280 makes the jump to public, it’ll likely become the preferred all-around software suite by early adopters, who were previously devoted to competitive offerings from Microsoft and Google.

More Natural Prosthetics

Prosthetics are becoming not only more natural-looking, but also more fluid in motion. One of the most cutting-edge products, the DEKA limb, can translate multiple simultaneous signals from muscle contractions and interpret them into movement precise enough to gently manipulate grapes. The limb (dubbed the “Luke” limb due to its similarity to Luke Skywalker’s bionic arm in Star Wars) was invented by DEKA Research and Development Corp. along with $40 million in funding from the U.S. Defense Advanced Research Projects Agency (DARPA) and the U.S. Army Research Office.

However, the company is privately traded and is waiting for a commercial partner to agree to mass produce them, according to Bloomberg.

Where You Can Invest

On May 12, one of the world’s most prestigious prosthetic makers, Hanger Inc. (NYSE: HGR), announced that longtime president Richmond L. Taylor would be replaced by Samuel M. Liang of Bayer AG (OTC: BAYRY) subsidiary Bayer Healthcare. It’s a stock worth investing in, but perhaps not right off the bat (the company hit a one-year low of $30 per share around May 6, and has remained around there since).

There are a handful of similarly yoked private businesses that could likely go public in the future, including BiOM, Ottobock, Endolite and Evolution Industries; each offering their own unique proprietary prosthetic solutions and a possible leg up to a better stock portfolio. Keep an eye open for fresh investment opportunities if – or when – they decide to go public.